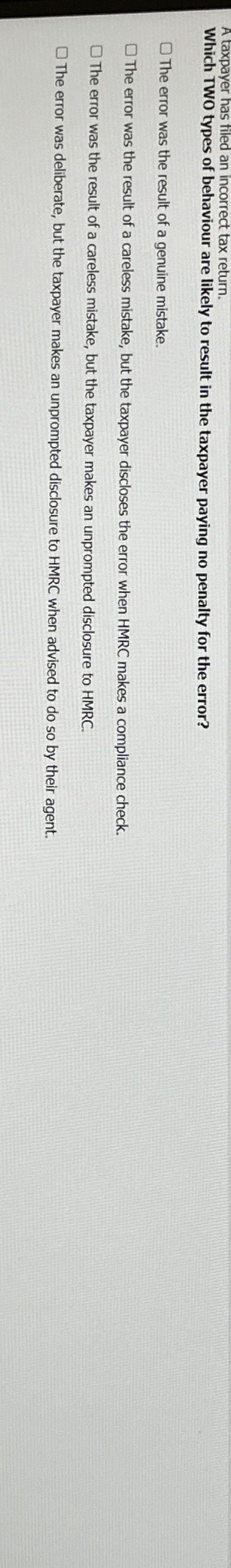

Question: A taxpayer has filed an incorrect tax return. Which TWO types of behaviour are likely to result in the taxpayer paying no penalty for the

A taxpayer has filed an incorrect tax return.

Which TWO types of behaviour are likely to result in the taxpayer paying no penalty for the error?

The error was the result of a genuine mistake.

The error was the result of a careless mistake, but the taxpayer discloses the error when HMRC makes a compliance check.

The error was the result of a careless mistake, but the taxpayer makes an unprompted disclosure to HMRC

The error was deliberate, but the taxpayer makes an unprompted disclosure to HMRC when advised to do so by their agent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock