Question: a) TCY just issued a junk-graded bond with a 12 percent annual coupon rate and semi- annual coupon payments. This bond has 15 years to

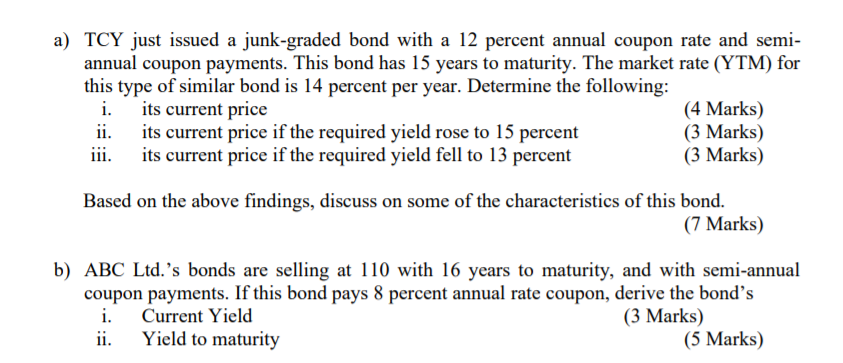

a) TCY just issued a junk-graded bond with a 12 percent annual coupon rate and semi- annual coupon payments. This bond has 15 years to maturity. The market rate (YTM) for this type of similar bond is 14 percent per year. Determine the following: i. its current price (4 Marks) ii. its current price if the required yield rose to 15 percent (3 Marks) iii. its current price if the required yield fell to 13 percent (3 Marks) Based on the above findings, discuss on some of the characteristics of this bond. (7 Marks) b) ABC Ltd.s bonds are selling at 110 with 16 years to maturity, and with semi-annual coupon payments. If this bond pays 8 percent annual rate coupon, derive the bond's i. Current Yield (3 Marks) ii. Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts