Question: A tech startup called COMICTV broadcasts live sessions with up-and-coming comedians. The company starts in New York and LA. The service is unique so

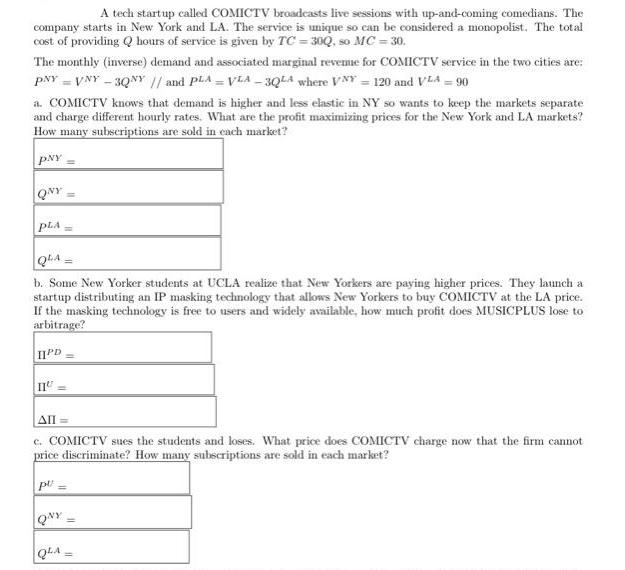

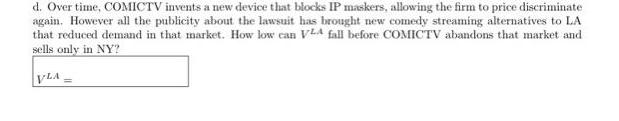

A tech startup called COMICTV broadcasts live sessions with up-and-coming comedians. The company starts in New York and LA. The service is unique so can be considered a monopolist. The total cost of providing hours of service is given by TC=300, so MC = 30. The monthly (inverse) demand and associated marginal reverne for COMICTV service in the two cities are: PNY VNY - 3QNY // and PLA - VLA-3QLA where VNY 120 and VLA = 90 a. COMICTV knows that demand is higher and less elastic in NY so wants to keep the markets separate and charge different hourly rates. What are the profit maximizing prices for the New York and LA markets? How many subscriptions are sold in each market? PNY = QNY= PLA b. Some New Yorker students at UCLA realize that New Yorkers are paying higher prices. They launch a startup distributing an IP masking technology that allows New Yorkers to buy COMICTV at the LA price. If the masking technology is free to users and widely available, how much profit does MUSICPLUS lose to arbitrage? IIPD= All = c. COMICTV sues the students and loses. What price does COMICTV charge now that the firm cannot price discriminate? How many subscriptions are sold in each market? p= QNY = = d. Over time, COMICTV invents a new device that blocks IP maskers, allowing the firm to price discriminate again. However all the publicity about the lawsuit has brought new comedy streaming alternatives to LA that reduced demand in that market. How low can VLA fall before COMICTV abandons that market and sells only in NY? VLA

Step by Step Solution

There are 3 Steps involved in it

a To determine the profitmaximizing prices and quantity of subscriptions sold in each market we need to compare the marginal revenue MR and marginal c... View full answer

Get step-by-step solutions from verified subject matter experts