Question: A technique known as the control variate technique can improve the accuracy of the pricing of an American option. This involves using the same tree

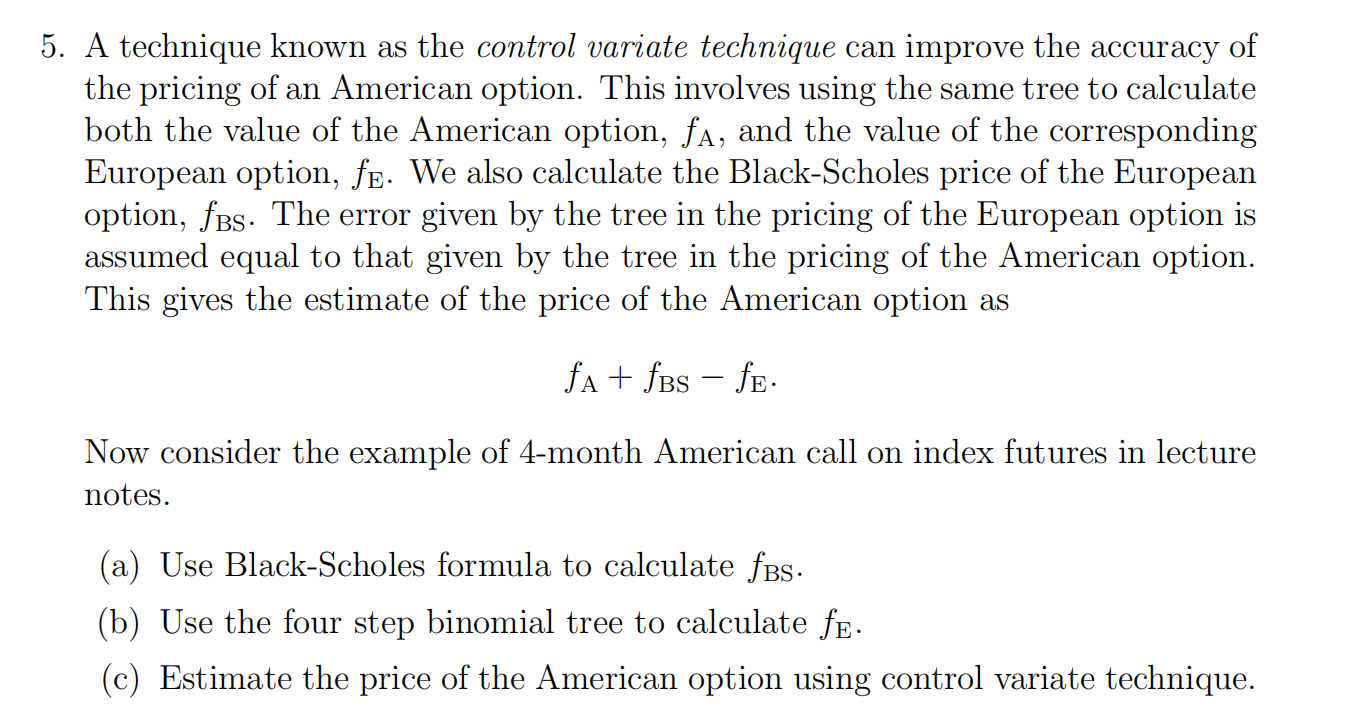

A technique known as the control variate technique can improve the accuracy of the pricing of an American option. This involves using the same tree to calculate both the value of the American option, fA, and the value of the corresponding European option, fE. We also calculate the Black-Scholes price of the European option, fBS. The error given by the tree in the pricing of the European option is assumed equal to that given by the tree in the pricing of the American option. This gives the estimate of the price of the American option as fA+fBSfE. Now consider the example of 4-month American call on index futures in lecture notes. (a) Use Black-Scholes formula to calculate fBS. (b) Use the four step binomial tree to calculate fE. (c) Estimate the price of the American option using control variate technique

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts