Question: A technique of accommodating uncertainty in evaluating capital projects is to calculate (a) the 1RR and (b) the NPV for a range of conditions rather

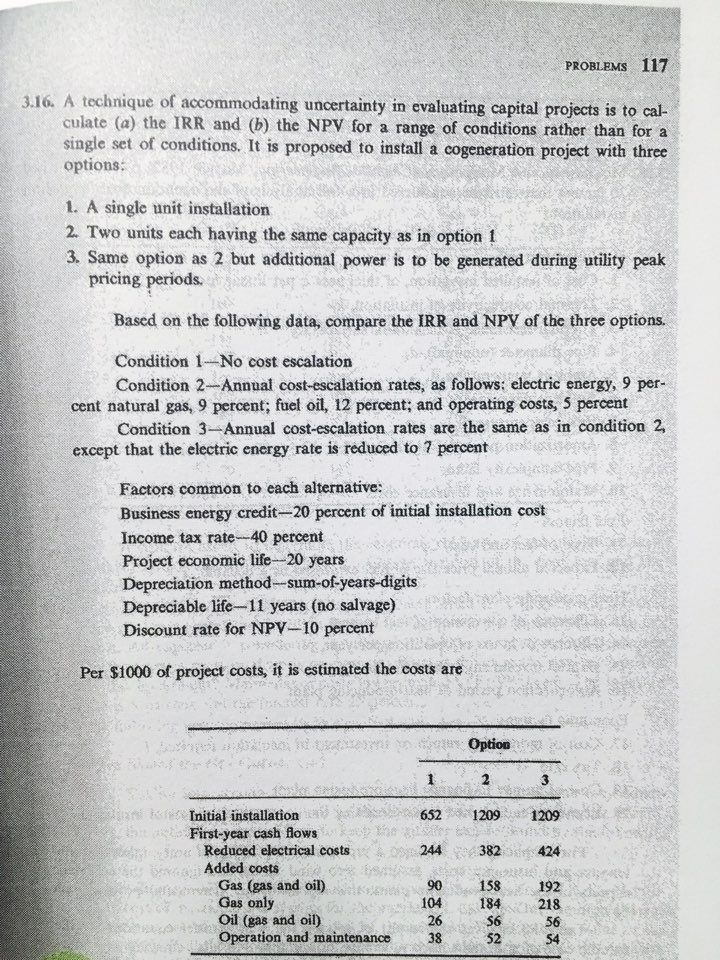

A technique of accommodating uncertainty in evaluating capital projects is to calculate (a) the 1RR and (b) the NPV for a range of conditions rather than for a single set ot conditions. It is proposed to install a cogeneration project with three options: A single unit installation Two units each having the same capacity as in option 1 Same option as 2 but additional power is to be generated during utility peak pricing periods. Based on the following data, compare the IRR and NPV of the three options. Condition l-No cost escalation Condition 2-Annual cost-escalation rates, as follows: electric energy, 9 percent natural gas, 9 percent; fuel oil, 12 percent; and operating costs, 5 percent Condition 3-Annual cost-escalation rates arc the same as in condition 2, except that the electric energy rate is reduced to 7 percent Factors common to each alternative: Business energy credit-20 percent of initial installation cost Income tax rate-40 percent Project economic life-20 years Depreciation method-sum-of-years-digits Depreciable life-11 years (no salvage) Discount rate for NPV-10 percent Per $1000 of project costs, it is estimated the costs are A technique of accommodating uncertainty in evaluating capital projects is to calculate (a) the 1RR and (b) the NPV for a range of conditions rather than for a single set ot conditions. It is proposed to install a cogeneration project with three options: A single unit installation Two units each having the same capacity as in option 1 Same option as 2 but additional power is to be generated during utility peak pricing periods. Based on the following data, compare the IRR and NPV of the three options. Condition l-No cost escalation Condition 2-Annual cost-escalation rates, as follows: electric energy, 9 percent natural gas, 9 percent; fuel oil, 12 percent; and operating costs, 5 percent Condition 3-Annual cost-escalation rates arc the same as in condition 2, except that the electric energy rate is reduced to 7 percent Factors common to each alternative: Business energy credit-20 percent of initial installation cost Income tax rate-40 percent Project economic life-20 years Depreciation method-sum-of-years-digits Depreciable life-11 years (no salvage) Discount rate for NPV-10 percent Per $1000 of project costs, it is estimated the costs are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts