Question: A ten year project involves equipment costing $3,470,000 that will be depreciated using the seven-year MACRS schedule. If the estimated pre-tax salvage value for the

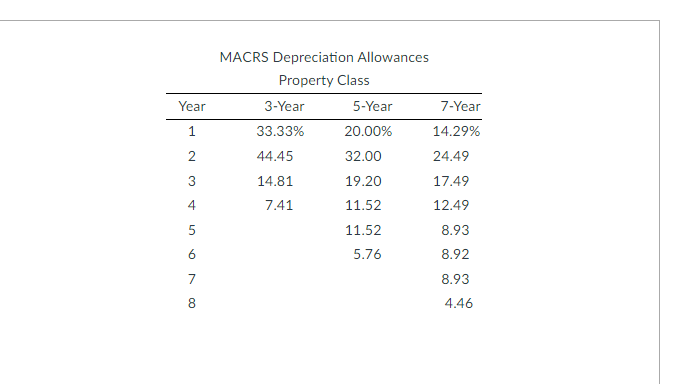

A ten year project involves equipment costing $3,470,000 that will be depreciated using the seven-year MACRS schedule. If the estimated pre-tax salvage value for the equipment at the end of the project's life is $451,100, what is the after-tax salvage value for the equipment? Assume a marginal tax rate of 34 percent.

Group of answer choices

$604,474

$398,953

-$5,899

$297,726

_________ occurs when the cash flows of a new project come at the expense of a firm's existing projects.

Group of answer choices

Deforestation

Erosion

Depreciation

Obfuscation

MACRS Depreciation Allowances Property Class Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.92 7 8.93 4.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts