Question: a. Ten years ago today, Excel Corp issued a regular coupon bond that had original maturity of 15 years. The bond pays interest semiannually and

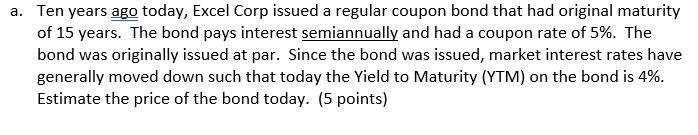

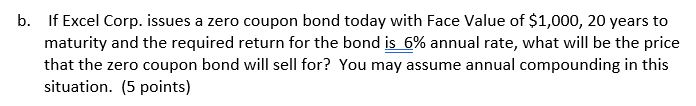

a. Ten years ago today, Excel Corp issued a regular coupon bond that had original maturity of 15 years. The bond pays interest semiannually and had a coupon rate of 5%. The bond was originally issued at par. Since the bond was issued, market interest rates have generally moved down such that today the Yield to Maturity (YTM) on the bond is 4%. Estimate the price of the bond today. (5 points) b. If Excel Corp. issues a zero coupon bond today with Face Value of $1,000, 20 years to maturity and the required return for the bond is 6% annual rate, what will be the price that the zero coupon bond will sell for? You may assume annual compounding in this situation. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts