Question: a) The banking system appears to be a systematic source of trouble, nearly always owing to bad loans or credit risk gone wrong. Misallocation of

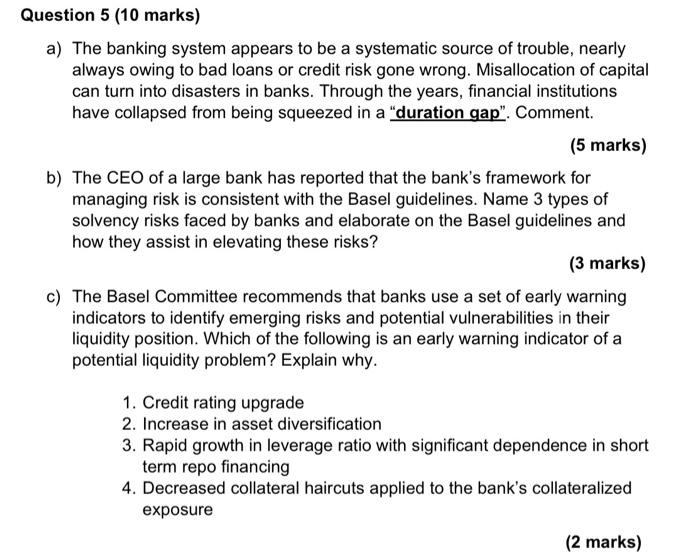

a) The banking system appears to be a systematic source of trouble, nearly always owing to bad loans or credit risk gone wrong. Misallocation of capital can turn into disasters in banks. Through the years, financial institutions have collapsed from being squeezed in a "duration gap". Comment. (5 marks) b) The CEO of a large bank has reported that the bank's framework for managing risk is consistent with the Basel guidelines. Name 3 types of solvency risks faced by banks and elaborate on the Basel guidelines and how they assist in elevating these risks? (3 marks) c) The Basel Committee recommends that banks use a set of early warning indicators to identify emerging risks and potential vulnerabilities in their liquidity position. Which of the following is an early warning indicator of a potential liquidity problem? Explain why. 1. Credit rating upgrade 2. Increase in asset diversification 3. Rapid growth in leverage ratio with significant dependence in short term repo financing 4. Decreased collateral haircuts applied to the bank's collateralized exposure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts