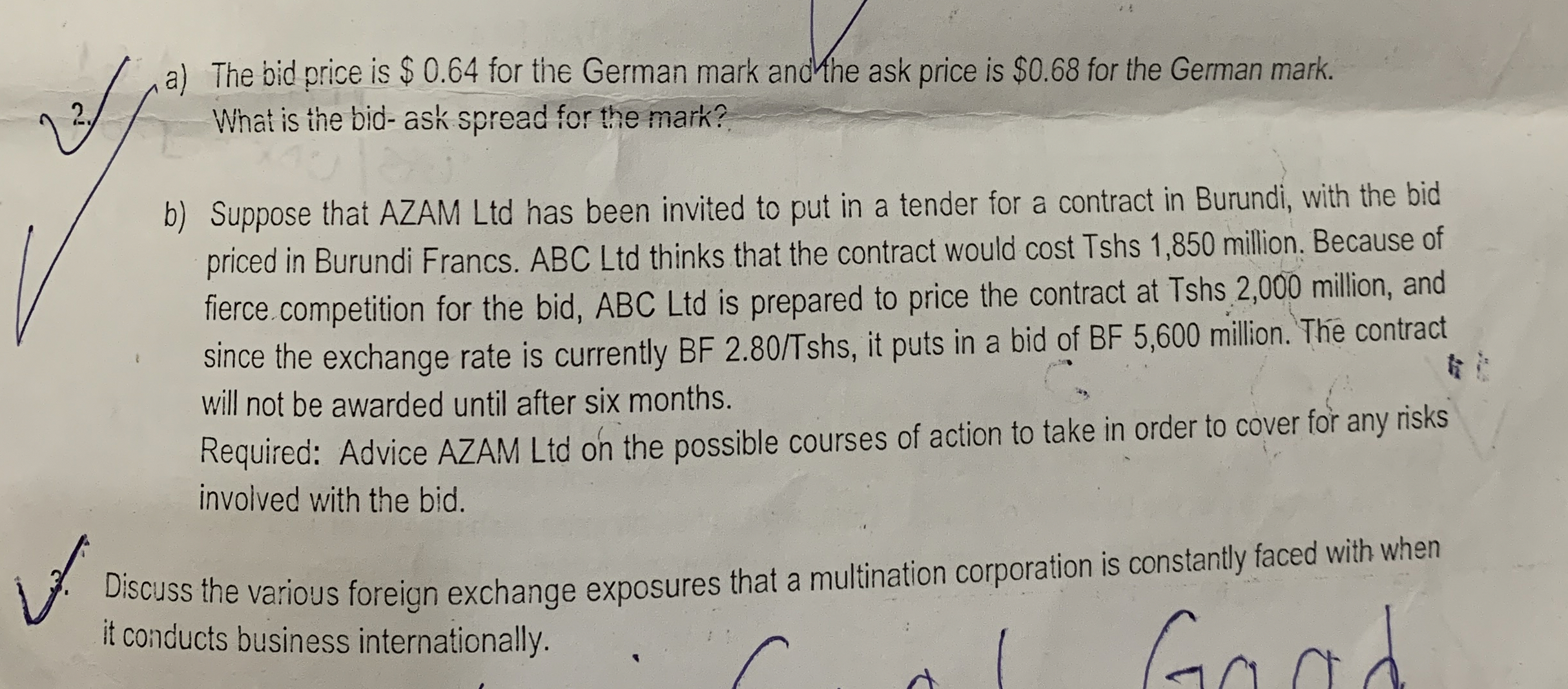

Question: a ) The bid price is $ 0 . 6 4 for the German mark and the ask price is $ 0 . 6 8

a The bid price is $ for the German mark and the ask price is $ for the German mark. What is the bid ask spread for the mark?

b Suppose that AZAM Ltd has been invited to put in a tender for a contract in Burundi, with the bid priced in Burundi Francs. ABC Ltd thinks that the contract would cost Tshs million. Because of fierce competition for the bid, ABC Ltd is prepared to price the contract at Tshs million, and since the exchange rate is currently Tshs it puts in a bid of million. The contract will not be awarded until after six months.

Required: Advice AZAM Ltd on the possible courses of action to take in order to cover for any risks involved with the bid.

Discuss the various foreign exchange exposures that a multination corporation is constantly faced with when it conducts business internationally.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock