Question: (a) The Bright company is evaluating a project which will cost Rs 1,00,000 and will have no salvage value at the end of its

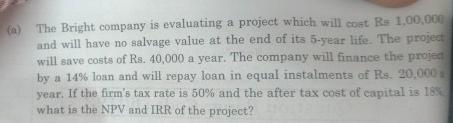

(a) The Bright company is evaluating a project which will cost Rs 1,00,000 and will have no salvage value at the end of its 5-year life. The project will save costs of Rs. 40,000 a year. The company will finance the projec by a 14% loan and will repay loan in equal instalments of Rs. 20,000 year. If the firm's tax rate is 50% and the after tax cost of capital is 18% what is the NPV and IRR of the project?

Step by Step Solution

There are 3 Steps involved in it

Given Data Initial Project Cost Rs 100000 Project Life 5 years Annual Cost Savings Rs 40000 Loan Interest Rate 14 Annual Loan Repayment Rs 20000 Firms Tax Rate 50 AfterTax Cost of Capital 18 Steps to ... View full answer

Get step-by-step solutions from verified subject matter experts