Question: ( a ) The current price of a non - dividend paying stock is ( $ 2 4 5 ) . Assume

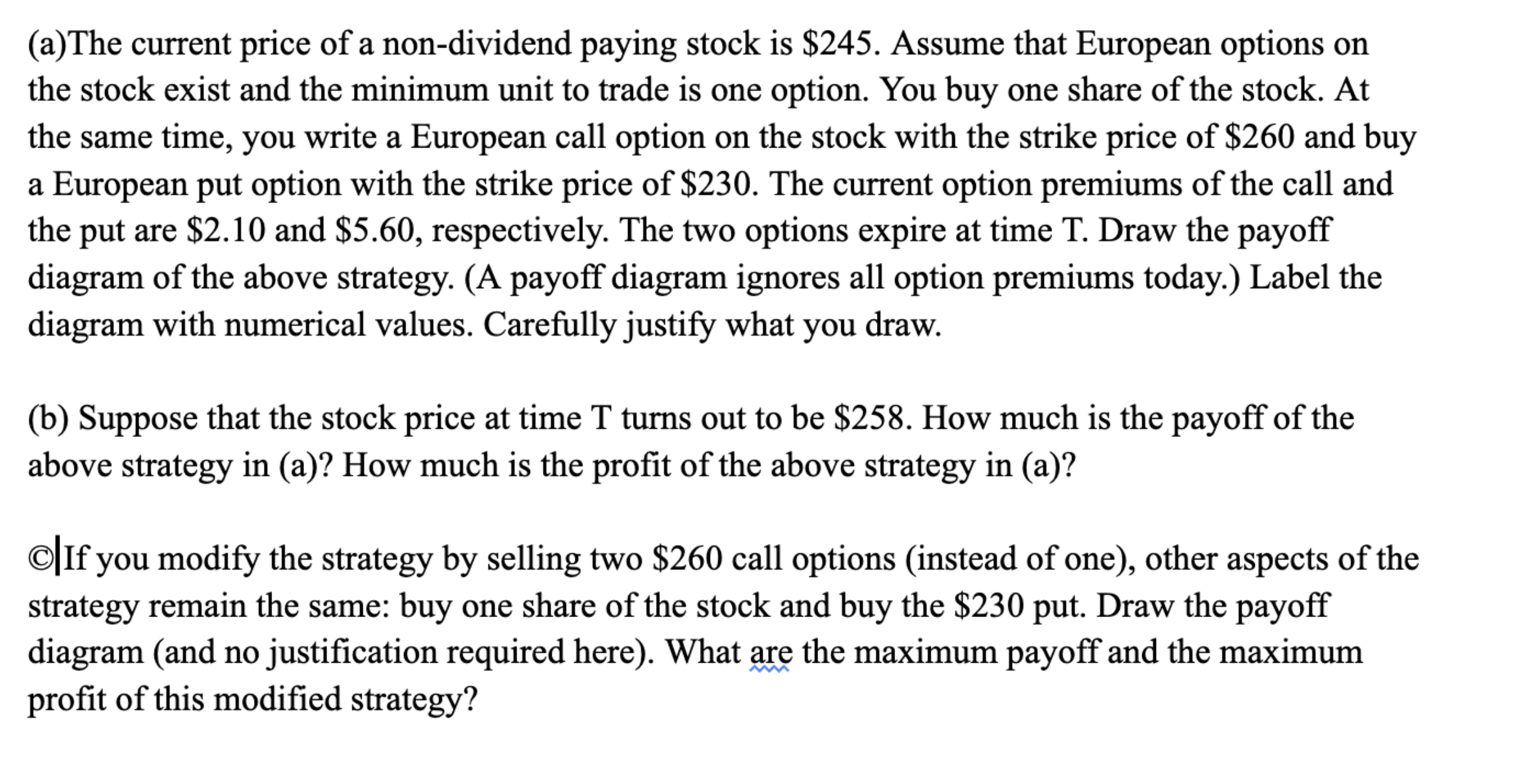

aThe current price of a nondividend paying stock is $ Assume that European options on the stock exist and the minimum unit to trade is one option. You buy one share of the stock. At the same time, you write a European call option on the stock with the strike price of $ and buy a European put option with the strike price of $ The current option premiums of the call and the put are $ and $ respectively. The two options expire at time T Draw the payoff diagram of the above strategy. A payoff diagram ignores all option premiums today. Label the diagram with numerical values. Carefully justify what you draw.

b Suppose that the stock price at time T turns out to be $ How much is the payoff of the above strategy in a How much is the profit of the above strategy in a

If you modify the strategy by selling two $ call options instead of one other aspects of the strategy remain the same: buy one share of the stock and buy the $ put. Draw the payoff diagram and no justification required here What are the maximum payoff and the maximum profit of this modified strategy?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock