Question: a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your answer to 4

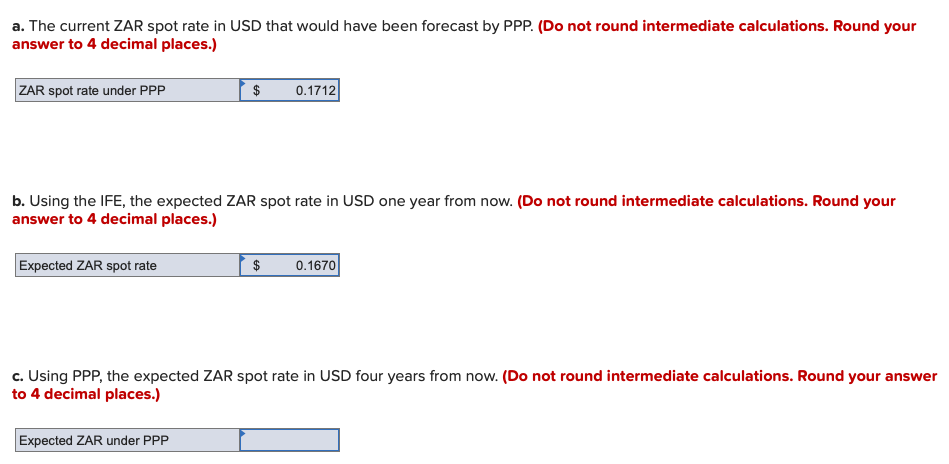

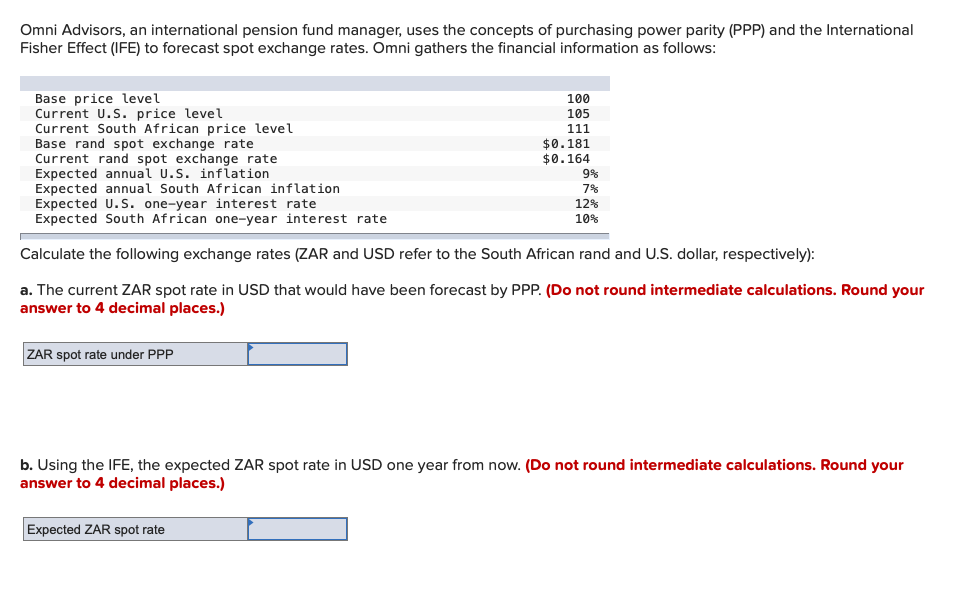

a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your answer to 4 decimal places.) ZAR spot rate under PPP $ 0.1712 b. Using the IFE, the expected ZAR spot rate in USD one year from now. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Expected ZAR spot rate $ 0.1670 c. Using PPP, the expected ZAR spot rate in USD four years from now. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Expected ZAR under PPP Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: Base price level Current U.S. price level Current South African price level Base rand spot exchange rate Current rand spot exchange rate Expected annual u.s. inflation Expected annual South African inflation Expected U.S. one-year interest rate Expected South African one-year interest rate 100 105 111 $0.181 $0.164 9% 7% 12% 10% Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively): a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your answer to 4 decimal places.) ZAR spot rate under PPP b. Using the IFE, the expected ZAR spot rate in USD one year from now. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Expected ZAR spot rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts