Question: A. The Expected Return (Arith) for the Weekly Portfolio is ______? B. The Expected Return (Arith) for the Weekly Benchmark is ______? Portfolio Weekly Return

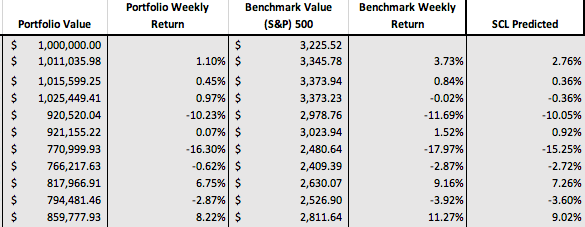

A. The Expected Return (Arith) for the Weekly Portfolio is ______?

B. The Expected Return (Arith) for the Weekly Benchmark is ______?

Portfolio Weekly Return Benchmark Weekly Return SCL Predicted Portfolio Value $ 1,000,000.00 $ 1,011,035.98 $ 1,015,599.25 1,025,449.41 920,520.04 921,155.22 770,999.93 766,217.63 817,966.91 794,481.46 859,777.93 1.10% 0.45% 0.97% -10.23% 0.07% -16.30% -0.62% 6.75% -2.87% 8.22% Benchmark Value (S&P) 500 3,225.52 3,345.78 3,373.94 3,373.23 2,978.76 3,023.94 2,480.64 2,409.39 2,630.07 2,526.90 $ 2,811.64 3.73% 0.84% -0.02% -11.69% 1.52% -17.97% -2.87% 9.16% -3.92% 11.27% 2.76% 0.36% -0.36% -10.05% 0.92% -15.25% -2.72% 7.26% -3.60% 9.02% S 85077 Portfolio Weekly Return Benchmark Weekly Return SCL Predicted Portfolio Value $ 1,000,000.00 $ 1,011,035.98 $ 1,015,599.25 1,025,449.41 920,520.04 921,155.22 770,999.93 766,217.63 817,966.91 794,481.46 859,777.93 1.10% 0.45% 0.97% -10.23% 0.07% -16.30% -0.62% 6.75% -2.87% 8.22% Benchmark Value (S&P) 500 3,225.52 3,345.78 3,373.94 3,373.23 2,978.76 3,023.94 2,480.64 2,409.39 2,630.07 2,526.90 $ 2,811.64 3.73% 0.84% -0.02% -11.69% 1.52% -17.97% -2.87% 9.16% -3.92% 11.27% 2.76% 0.36% -0.36% -10.05% 0.92% -15.25% -2.72% 7.26% -3.60% 9.02% S 85077

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts