(a) The following are the costing records for the year 2017 of a manufacturer: Production 20,000...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

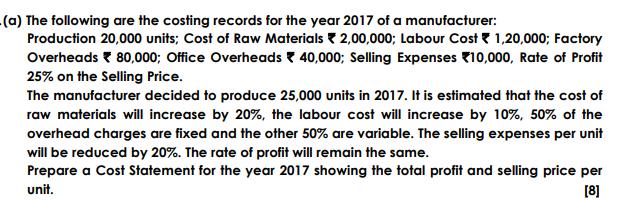

(a) The following are the costing records for the year 2017 of a manufacturer: Production 20,000 units; Cost of Raw Materials 2,00,000; Labour Cost 1,20,000; Factory Overheads 80,000; Office Overheads 40,000; Selling Expenses 10,000, Rate of Profit 25% on the Selling Price. The manufacturer decided to produce 25,000 units in 2017. It is estimated that the cost of raw materials will increase by 20%, the labour cost will increase by 10%, 50% of the overhead charges are fixed and the other 50% are variable. The selling expenses per unit will be reduced by 20%. The rate of profit will remain the same. Prepare a Cost Statement for the year 2017 showing the total profit and selling price per unit. [8] (a) The following are the costing records for the year 2017 of a manufacturer: Production 20,000 units; Cost of Raw Materials 2,00,000; Labour Cost 1,20,000; Factory Overheads 80,000; Office Overheads 40,000; Selling Expenses 10,000, Rate of Profit 25% on the Selling Price. The manufacturer decided to produce 25,000 units in 2017. It is estimated that the cost of raw materials will increase by 20%, the labour cost will increase by 10%, 50% of the overhead charges are fixed and the other 50% are variable. The selling expenses per unit will be reduced by 20%. The rate of profit will remain the same. Prepare a Cost Statement for the year 2017 showing the total profit and selling price per unit. [8]

Expert Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0176509736

10th Canadian Edition, Volume 1

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

Posted Date:

Students also viewed these accounting questions

-

It is estimated that next year hourly wage rates will increase by 7 percent and productivity will increase by 5 percent. What would you expect to happen to unit labor cost? Discuss how this unit...

-

It is estimated that 3.5% of the general population will live past their 90th birthday. In a graduating class of 753 high school seniors, what is the probability that: (a) 15 or more will live beyond...

-

It is estimated that in 2030, there will be a total of 4.072 million knee replacement and hip replacement surgeries, with knee replacements outnumbering hip replacements by 2.928 million (Source:...

-

Create two different unique demonstrations of Porous Defenses such as: Missing Encryption of Sensitive Data, Use of Hard-coded Credentials, Missing Authorization, Missing Authentication for Critical...

-

Lealos, Inc., is considering a change in its cash-only sales policy. The new terms of sale would be net one month. Based on the following information, determine if Lealos should proceed or not....

-

1. What functional strategies at Starbucks help the company to achieve superior financial performance? 2. Identify the resources, capabilities, and distinctive competencies of Starbucks? 3. How do...

-

Show that during the early part of the electron-positron annihilation era, the ratio of the electron number density to the photon number density scaled with temperature as \[\frac{n_{-}}{n_{\gamma}}...

-

Tierney County Total Governmental Funds Preclosing Trial Balance December 31, 20X5 Debit Credit Additional Information 1. The beginning trial balance of the general capital assets and general...

-

A 'drought simply is a situation in which quantity of water demanded exceeds quantity of water supplied. Draw a demand-supply diagram for the water market portraying a drought. Does a drought have...

-

This problem asks you to analyze the capital structure of HCA, Inc., the largest private operator of health care facilities in the world. In 2006, a syndicate of private equity firms acquired the...

-

Use the breadth-first and depth-first search algorithm to find spanning trees of the graph in Figure 1.21, with the root of the tree at v and the ordering of the vertices being (v, 2,...,Ug). Show...

-

Explain the traits that would characterize a servant leader and discuss the strengths and weaknesses of the servant leadership style on employees and organizations, as a whole. Be sure to support...

-

Suppose you bought a bond from Apple Inc. for $100 in 2009, in 2019 you sold it at $400. 100% inflation and your capital gain is taxed at a rate of 40%. 1). What is the pre-tax return? 2). What is...

-

In a forward propagation mechanism for a neural network with 2 input nodes, 1 hidden layer with 2 nodes, and 2 output values and a logistic activation function, we have the following input data: x1 =...

-

Explain what the wholesale price is. Why must manufacturers make sure that their initial costs are accurate?

-

Using the midpoint method: Compute the income elasticity of good Z. State what kind of good Z is (inferior, necessity, or luxury?) (7 marks) Hint: To obtain the effect of Income only, you need to...

-

On June 17, 2020, Popcorn Company received $50,000 from selling equipment that cost $120,000, had a useful life of 5 years, a residual value of $20,000, and under straight-line depreciation,...

-

What is the shape of the exponential distribution?

-

The bookkeeper for Garfield Corp. has prepared the following statement of financial position as at July 31, 2014: The following additional information is provided: 1. Cash includes $1,200 in a petty...

-

During the current year, Garrison Construction ttaded in two relatively new small cranes (cranes no. 6RTand S79) for a larger crane that Garrison expects will be more useful for the particular...

-

What follows is part of the testimony from Troy Normand in the WorldCom case. He was a manager in the corporate reporting department and is one of five individuals who pleaded guilty. He testified in...

-

Bethany, who weighs 560 N, lies in a hammock suspended by ropes tied to two trees. One rope makes an angle of 45 with the ground; the other makes an angle of 30. Find the tension in each of the ropes.

-

In the Skycoaster amusement park ride, riders are suspended from a tower by a long cable. A second cable then lifts them until they reach the starting position indicated in Figure P5.3. The lifting...

-

In the winter sport of curling, two teams alternate sliding 20 kg stones on an icy surface in an attempt to end up with the stone closest to the center of a target painted on the ice. During one...

Study smarter with the SolutionInn App