Question: (a) The following data was obtained from Belcom Microfinance- a licensed microfinance Bank during the financial year 2020-2021: Net Income: $. 1,500,000 Number of equity

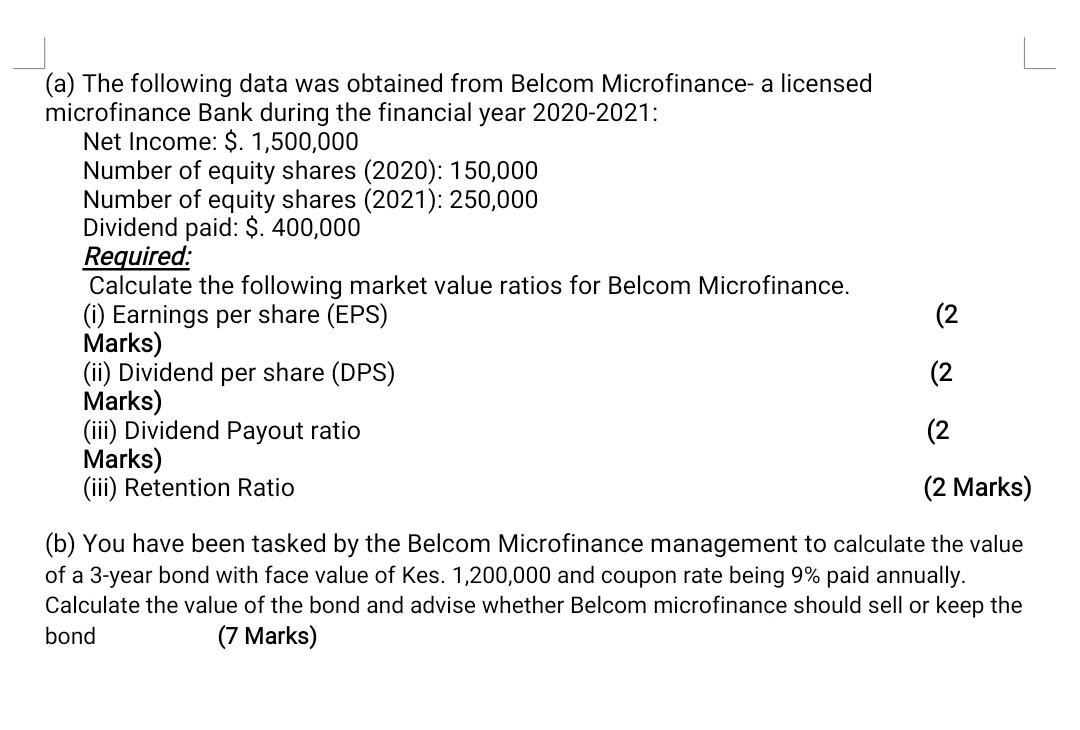

(a) The following data was obtained from Belcom Microfinance- a licensed microfinance Bank during the financial year 2020-2021: Net Income: \$. 1,500,000 Number of equity shares (2020): 150,000 Number of equity shares (2021): 250,000 Dividend paid: $.400,000 Required: Calculate the following market value ratios for Belcom Microfinance. (i) Earnings per share (EPS) (2 Marks) (2 Marks) (iii) Dividend Payout ratio (2 Marks) (iii) Retention Ratio (2 Marks) (b) You have been tasked by the Belcom Microfinance management to calculate the value of a 3-year bond with face value of Kes. 1,200,000 and coupon rate being 9% paid annually. Calculate the value of the bond and advise whether Belcom microfinance should sell or keep the bond (7 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts