Question: a) The following excerpts are from two articles published in the Australian Financial Review in 2021. These articles highlight the debate over the merits of

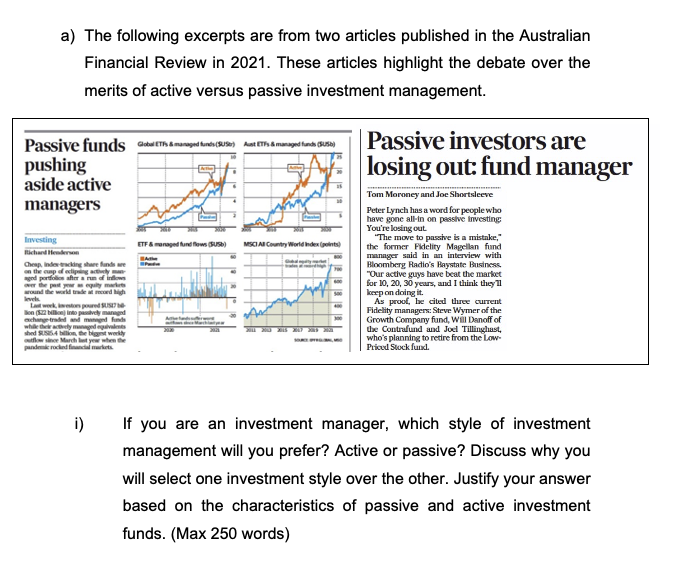

a) The following excerpts are from two articles published in the Australian Financial Review in 2021. These articles highlight the debate over the merits of active versus passive investment management. Passive funds Global ETFs & managed funds (US) Aust ETFs & managed funds (US) Passive investors are losing out: fund manager pushing aside active managers Tom Moroney and Joe Shortsleeve Peter Lynch has a word for people who have gone all-in on passive investing You're losing out. Investing ETF & managed fund flows (US) MSCI All Country World Index() Richard Henderson Cheap, inder-tracking share funds are on the cusp of eclipsing actively man aged portfolios finflows "The move to passive is a mistake," the former Fidelity Magellan fund manager said in an interview with Bloomberg Radio's Baystate Business. "Our active guys have beat the market for 10, 20, 30 years, and I think they'11 keep on doing it. over the past year equity markets around the world trade at record high levels Last week, investors poured US Bon (522 billion into pavely managed exchange-traded and managed funds while their actively managed equivalents shed SUS5.4 billion, the big werky A As proof, he cited three current Fidelity managers: Steve Wymer of the Growth Company fund, Will Danoff of the Contrafund and Joel Tillinghast, who's planning to retire from the Low- Priced Stock fund. outflow since March let year when the pandemic rocked financial markets. i) If you are an investment manager, which style of investment management will you prefer? Active or passive? Discuss why you will select one investment style over the other. Justify your answer based on the characteristics of passive and active investment funds. (Max 250 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts