Question: The following information had not been considered before preparing the trial balance: a. The $100,000 note receivable was signed by a major customer. It is

The following information had not been considered before preparing the trial balance:

a. The $100,000 note receivable was signed by a major customer. It is a 3-month note dated November 1, 20X0. Interest earned during November and December was collected in cash at 4 PM on December 31. The interest rate is 6% per year.

b. The Prepaid Insurance account reflects a 1-year fire insurance policy acquired for $12,000 cash on September 1, 20X0.

c. Depreciation for 20X0 was $18,000.

d. Vancouver Computing paid wages of $12,000 in cash at 5 PM on December 31.

Required

1. Enter the December 31 balances in T-accounts in a general ledger. Number the accounts. Allow room for additional T-accounts.

2. Prepare the journal entries prompted by the additional information. Show amounts in thousands.

3. Post the journal entries to the ledger. Key your postings. Create logical new account numbers as necessary.

4. Prepare a new trial balance, December 31, 20X0.

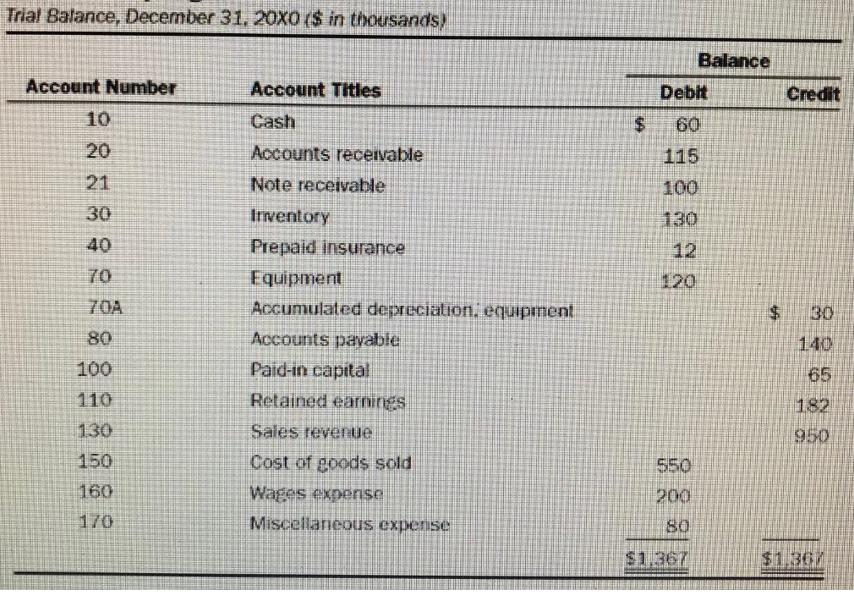

Trial Balance, December 31,20X0 ($ in thousands) Balance Account Number Account Titles Debit Credit 10 Cash 60 20 Accounts recervable 115 21 Note receivable 100 30 Inventory 130 40 Prepaid insurance 12 70 120 70A Accumulated depreciation, equipment 30 80 Accounts payable 140 Paid-in capital Retained earnings 100 65 110 182 130 Sales revenue 950 150 Cost of goods sold 550 160 Wages experse Miscellaneous expense 200 1/0 80 $1,367 $1.367 %24

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Answers JOURNAL ENTRIES Sno Particulars Dr in 000 Cr in 000 a Cash Account Dr 1 Interest Revenue Cr ... View full answer

Get step-by-step solutions from verified subject matter experts