Question: (a) The table below shows the prices as a function of yields for two bonds. Bond A Bond B 6.0% 111.5 104.0 6.5% 105.5 103.5

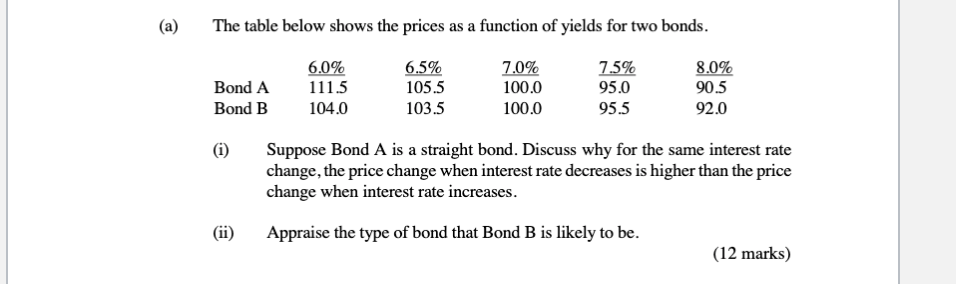

(a) The table below shows the prices as a function of yields for two bonds. Bond A Bond B 6.0% 111.5 104.0 6.5% 105.5 103.5 7.0% 100.0 100.0 7.5% 95.0 95.5 8.0% 90.5 92.0 (i) Suppose Bond A is a straight bond. Discuss why for the same interest rate change, the price change when interest rate decreases is higher than the price change when interest rate increases. Appraise the type of bond that Bond B is likely to be. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts