Question: A . times frms eil need to dedide if they want to centinue to use their arrenk equipment of replace the equipment with nemer equipmen.

A times frms eil need to dedide if they want to centinue to use their arrenk equipment of replace the equipment with nemer equipmen. The

company will faed to do ropicement analysis to determine which option is the best financial decisisn for the company.

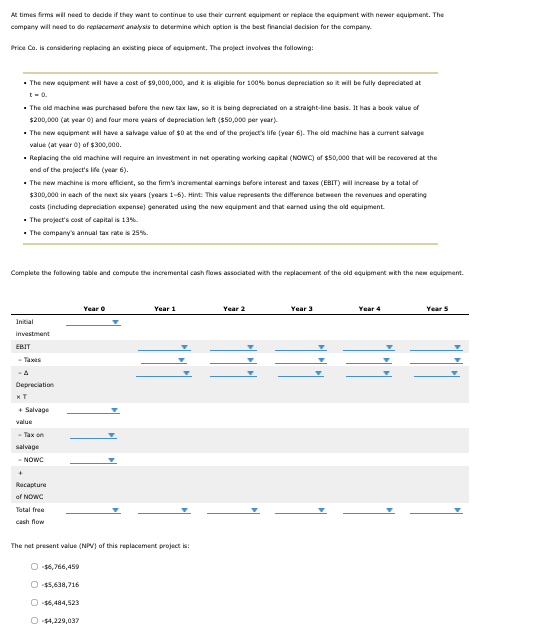

The new equipmerk wil have a cost of $ and ir is eligible for bonus depreciation so it mill be fully deprediated at

The old machine wax purchased before the new tax law, so it is being depreciated on a straightline basis. It has a beok value of

$ak year and four more years of depreciation left per vear :

value at year o of $

Peplacing the old machine will require an investment in fet eperating working capikal NowC of $ that will be rectrvered at the

end of the project's life year

The new machine is more efficient, so the firm's incremerkal earnings before interest and taxes EaIT mill increase by a total of

casts fincluding depreciation expense generated using the few equipment and thak earned using the old equipment.

The project's cost of capital is

The companys anfual tax rate is

The fnet present value of this replacement project is:

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock