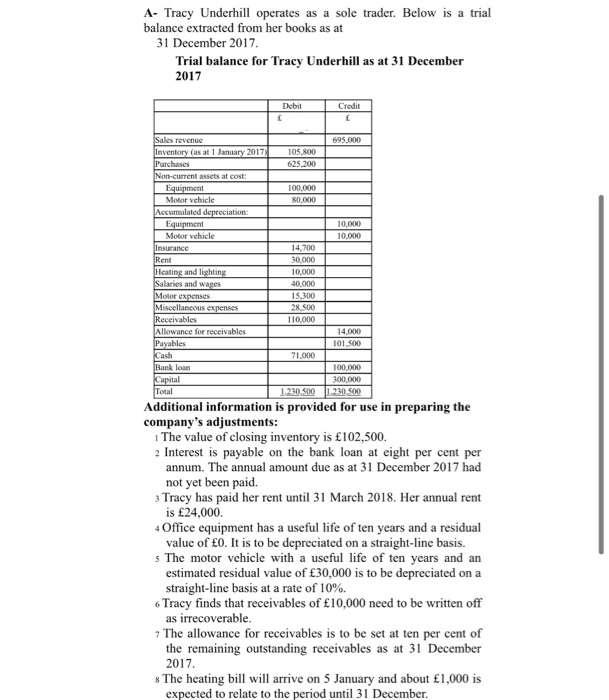

Question: A- Tracy Underhill operates as a sole trader. Below is a trial balance extracted from her books as at 31 December 2017 Trial balance for

A- Tracy Underhill operates as a sole trader. Below is a trial balance extracted from her books as at 31 December 2017 Trial balance for Tracy Underhill as at 31 December 2017 Debit Credit f 695.000 105,800 625,200 100,000 80,000 10.000 10.000 Sales revenue Inventory (as at 1 January 2017 Purchases Non-current assets at cost: Equipment Motor vehicle Accumulated depreciation: Equipment Motor vehicle Insurance Rent Heating and lighting Salaries and wages Motor expenses Miscellaneous expenses Receivables Allowance for receivables Payables Cash Bank loan Capital Total 14,700 30.000 10,000 40.000 15.300 28 500 110.000 14.000 101.500 71.000 100.000 300,000 1.230 500 1.230.500 Additional information is provided for use in preparing the company's adjustments: The value of closing inventory is 102,500. 2 Interest is payable on the bank loan at eight per cent per annum. The annual amount due as at 31 December 2017 had not yet been paid. 3 Tracy has paid her rent until 31 March 2018. Her annual rent is 24,000. + Office equipment has a useful life of ten years and a residual value of O. It is to be depreciated on a straight-line basis. s The motor vehicle with a useful life of ten years and an estimated residual value of 30,000 is to be depreciated on a straight-line basis at a rate of 10%. 6 Tracy finds that receivables of 10,000 need to be written off as irrecoverable. 7 The allowance for receivables is to be set at ten per cent of the remaining outstanding receivables as at 31 December 2017. $ The heating bill will arrive on 5 January and about 1,000 is expected to relate to the period until 31 December A- Tracy Underhill operates as a sole trader. Below is a trial balance extracted from her books as at 31 December 2017 Trial balance for Tracy Underhill as at 31 December 2017 Debit Credit f 695.000 105,800 625,200 100,000 80,000 10.000 10.000 Sales revenue Inventory (as at 1 January 2017 Purchases Non-current assets at cost: Equipment Motor vehicle Accumulated depreciation: Equipment Motor vehicle Insurance Rent Heating and lighting Salaries and wages Motor expenses Miscellaneous expenses Receivables Allowance for receivables Payables Cash Bank loan Capital Total 14,700 30.000 10,000 40.000 15.300 28 500 110.000 14.000 101.500 71.000 100.000 300,000 1.230 500 1.230.500 Additional information is provided for use in preparing the company's adjustments: The value of closing inventory is 102,500. 2 Interest is payable on the bank loan at eight per cent per annum. The annual amount due as at 31 December 2017 had not yet been paid. 3 Tracy has paid her rent until 31 March 2018. Her annual rent is 24,000. + Office equipment has a useful life of ten years and a residual value of O. It is to be depreciated on a straight-line basis. s The motor vehicle with a useful life of ten years and an estimated residual value of 30,000 is to be depreciated on a straight-line basis at a rate of 10%. 6 Tracy finds that receivables of 10,000 need to be written off as irrecoverable. 7 The allowance for receivables is to be set at ten per cent of the remaining outstanding receivables as at 31 December 2017. $ The heating bill will arrive on 5 January and about 1,000 is expected to relate to the period until 31 December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts