Question: A trader holds a complicated portfolio whose value depends on the price of a stock. The trader wants to manage this risk. To do so,

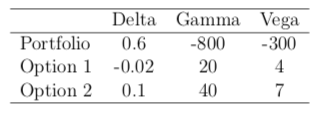

A trader holds a complicated portfolio whose value depends on the price of a stock. The trader wants to manage this risk. To do so, the trader can take positions (long or short) in the underlying stock and in two options on the stock. The Delta, Gamma, and Vega of the portfolio and the two options are given below. What position in the two options and the stock (in addition to the portfolio already held) can make the traders combined position Gamma neutral, Vega neutral, and Delta neutral?

Portfolio Option 1 Option 2 Delta Gamma Vega 0.6 -800 -300 -0.02 20 0.1 Portfolio Option 1 Option 2 Delta Gamma Vega 0.6 -800 -300 -0.02 20 0.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts