Question: A trader intends to sell 5 , 4 4 5 b b l of crude oil on the spot market on April 2 8 and

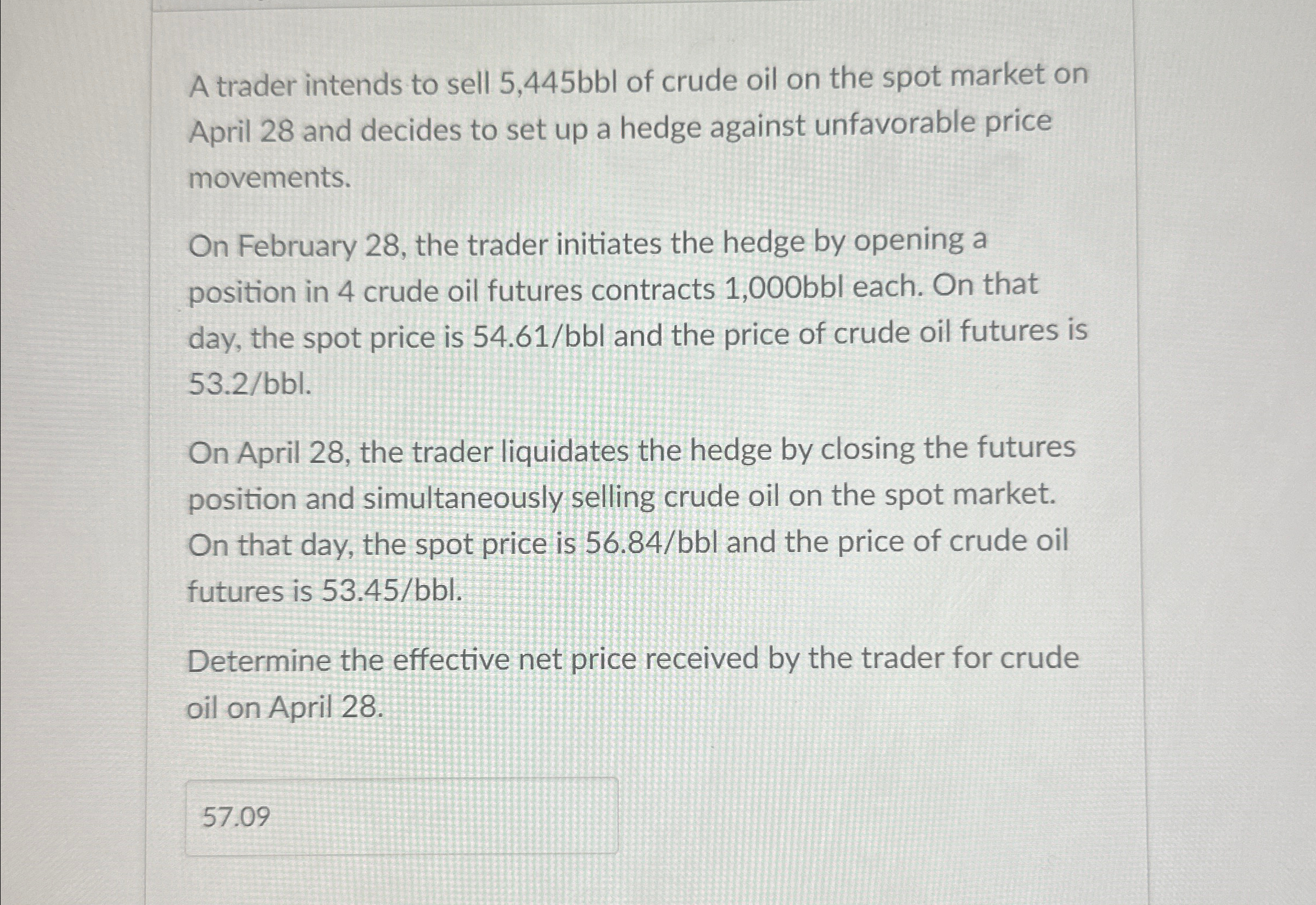

A trader intends to sell of crude oil on the spot market on April and decides to set up a hedge against unfavorable price movements.

On February the trader initiates the hedge by opening a position in crude oil futures contracts each. On that day, the spot price is and the price of crude oil futures is

On April the trader liquidates the hedge by closing the futures position and simultaneously selling crude oil on the spot market. On that day, the spot price is and the price of crude oil futures is

Determine the effective net price received by the trader for crude oil on April

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock