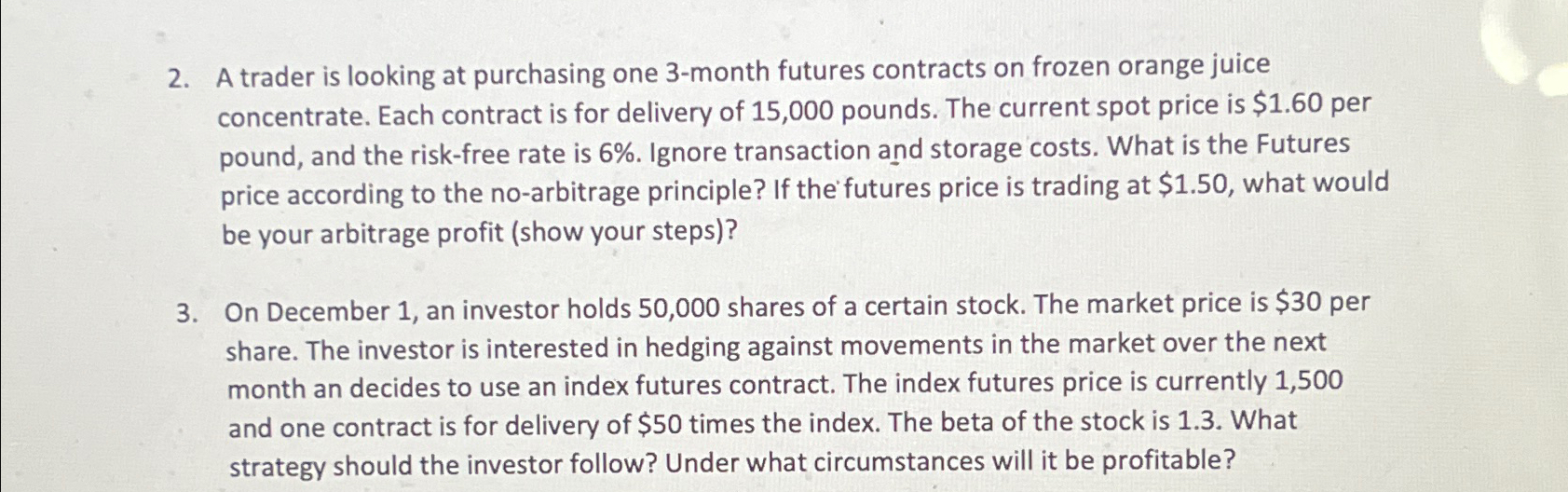

Question: A trader is looking at purchasing one 3 - month futures contracts on frozen orange juice concentrate. Each contract is for delivery of 1 5

A trader is looking at purchasing one month futures contracts on frozen orange juice concentrate. Each contract is for delivery of pounds. The current spot price is $ per pound, and the riskfree rate is Ignore transaction and storage costs. What is the Futures price according to the noarbitrage principle? If the futures price is trading at $ what would be your arbitrage profit show your steps

On December an investor holds shares of a certain stock. The market price is $ per share. The investor is interested in hedging against movements in the market over the next month an decides to use an index futures contract. The index futures price is currently and one contract is for delivery of $ times the index. The beta of the stock is What strategy should the investor follow? Under what circumstances will it be profitable?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock