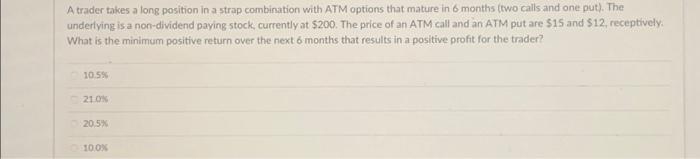

Question: A trader takes a long position in a strap combination with ATM options that mature in 6 months (two calls and one put). The underlying

A trader takes a long position in a strap combination with ATM options that mature in 6 months (two calls and one put). The undertying is a non-dividend paying stock, currently at $200. The price of an ATM call and an ATM put are $15 and $12, receptively. What is the minimum positive return over the next 6 months that results in a positive profit for the trader? 10.58 20.5% thouk A trader takes a long position in a strap combination with ATM options that mature in 6 months (two calls and one put). The undertying is a non-dividend paying stock, currently at $200. The price of an ATM call and an ATM put are $15 and $12, receptively. What is the minimum positive return over the next 6 months that results in a positive profit for the trader? 10.58 20.5% thouk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts