Question: A Treasurer buys a 6-month CD issued by a top-class bank with a tenor of 180 days at a yield of 16%. The face

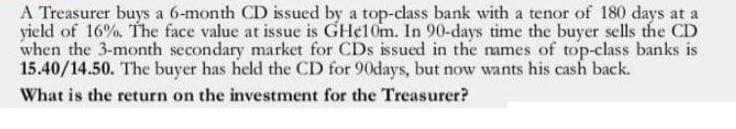

A Treasurer buys a 6-month CD issued by a top-class bank with a tenor of 180 days at a yield of 16%. The face value at issue is GHe10m. In 90-days time the buyer sells the CD when the 3-month secondary market for CDs issued in the mames of top-class banks is 15.40/14.50. The buyer has held the CD for 90days, but now wants his cash back. What is the return on the investment for the Treasurer?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Yield 16016 Buying value of CD 1010... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock