Question: A. TRUE / FALSE QUESTIONS Write either True or False on the blank preceding each question. 1. Angel investor(s) are typically one or two investors

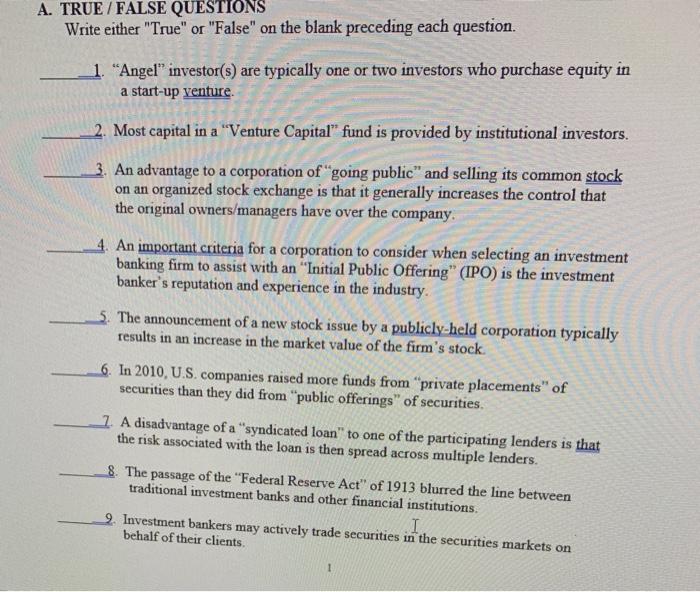

A. TRUE / FALSE QUESTIONS Write either "True" or "False" on the blank preceding each question. 1. "Angel" investor(s) are typically one or two investors who purchase equity in a start-up venture. 2. Most capital in a "Venture Capital" fund is provided by institutional investors. 3. An advantage to a corporation of "going public" and selling its common stock on an organized stock exchange is that it generally increases the control that the original owners/managers have over the company. 4. An important criteria for a corporation to consider when selecting an investment banking firm to assist with an "Initial Public Offering" (IPO) is the investment banker's reputation and experience in the industry. The announcement of a new stock issue by a publicly-held corporation typically results in an increase in the market value of the firm's stock. 6. In 2010, U.S. companies raised more funds from "private placements" of securities than they did from "public offerings" of securities 1. A disadvantage of a "syndicated loan" to one of the participating lenders is that the risk associated with the loan is then spread across multiple lenders. 8. The passage of the "Federal Reserve Act" of 1913 blurred the line between traditional investment banks and other financial institutions. I 9. Investment bankers may actively trade securities in the securities markets on behalf of their clients. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts