Question: A turnkey contractor was awarded a contract to construct a bridge crossing the river which separated the town with deferred terms of payment over a

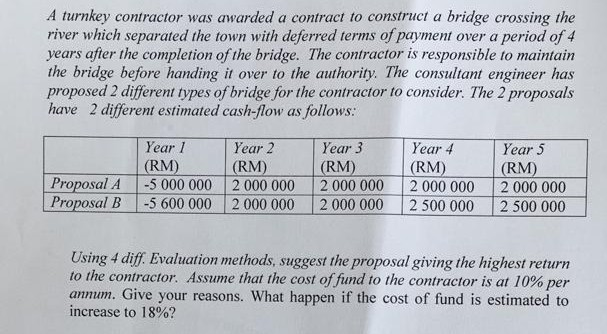

A turnkey contractor was awarded a contract to construct a bridge crossing the river which separated the town with deferred terms of payment over a period of 4 years after the completion of the bridge. The contractor is responsible to maintain the bridge before handing it over to the authority. The consultant engineer has proposed 2 different types of bridge for the contractor to consider. The 2 proposals have 2 different estimated cash-flow as follows: Year 1 (RM) Year 3 Year 2 Year 4 Year 5 (RM) 2 000 000 (RM) 2 000 000 (RM) 2 000 000 (RM) 2 000 000 Proposal A Proposal B -5 000 000 -5 600 000 2 000 000 2 000 000 2 500 000 2 500 000 Using 4 diff. Evaluation methods, suggest the proposal giving the highest return to the contractor. Assume that the cost of fund to the contractor is at 10% per annum. Give your reasons. What happen if the cost of fund is estimated to increase to 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts