Question: A two-class sequential pay collateralized mortgage obligation (CMO) has an initial outstanding principal balance of $29,000,000 million per class. The interest rates associated with Tranches

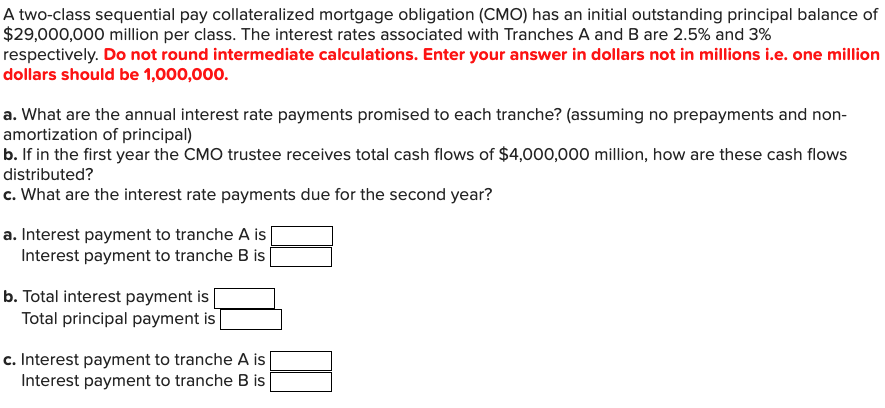

A two-class sequential pay collateralized mortgage obligation (CMO) has an initial outstanding principal balance of $29,000,000 million per class. The interest rates associated with Tranches A and B are 2.5% and 3% respectively. Do not round intermediate calculations. Enter your answer in dollars not in millions i.e. one million dollars should be 1,000,000. a. What are the annual interest rate payments promised to each tranche? (assuming no prepayments and non- amortization of principal) b. If in the first year the CMO trustee receives total cash flows of $4,000,000 million, how are these cash flows distributed? c. What are the interest rate payments due for the second year? a. Interest payment to tranche A is Interest payment to tranche B is b. Total interest payment is | Total principal payment is c. Interest payment to tranche A is Interest payment to tranche B is A two-class sequential pay collateralized mortgage obligation (CMO) has an initial outstanding principal balance of $29,000,000 million per class. The interest rates associated with Tranches A and B are 2.5% and 3% respectively. Do not round intermediate calculations. Enter your answer in dollars not in millions i.e. one million dollars should be 1,000,000. a. What are the annual interest rate payments promised to each tranche? (assuming no prepayments and non- amortization of principal) b. If in the first year the CMO trustee receives total cash flows of $4,000,000 million, how are these cash flows distributed? c. What are the interest rate payments due for the second year? a. Interest payment to tranche A is Interest payment to tranche B is b. Total interest payment is | Total principal payment is c. Interest payment to tranche A is Interest payment to tranche B is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts