Question: A U . S . based firm is required to make a large payment, denominated in euros, six months from today related to the purchase

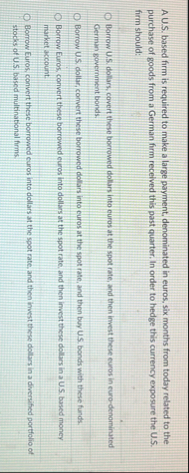

A US based firm is required to make a large payment, denominated in euros, six months from today related to the purchase of goods from a German firm recelved this past quarter, In order to hedge this currency exposure the US firm should:

Borrow US dollars, covert theve borrowed dolars into euros at the spot rate, and then invest these euros in eurodenominated German eovernment bonds.

Borrow US doltar, convert these borrowed dollars into curos at the spot rate, and then buy US bonds with these funds.

Borrow Euros, convert these borrowed euros into dollars at the spot rate. and then invest these dollars in a US based money market account.

Borrow Euros, convert these borrowed euros into dollars at the spot rate, and then imest these dollars in a diversifed portfolio of stocks of US based multinational firms.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock