Question: A U.S. bank issues a 1-year, $1 million U.S. CD at 5% annual interest to finance a CAD 1.274 million investment in 2-year fixed-rate Canadian

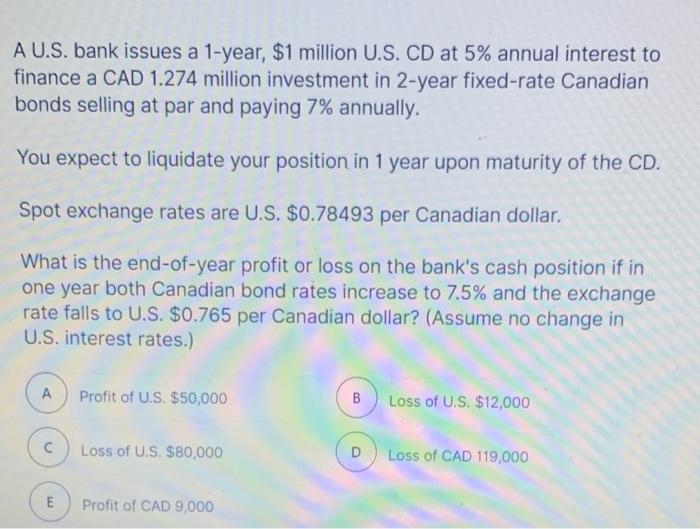

A U.S. bank issues a 1-year, $1 million U.S. CD at 5% annual interest to finance a CAD 1.274 million investment in 2-year fixed-rate Canadian bonds selling at par and paying 7% annually. You expect to liquidate your position in 1 year upon maturity of the CD. Spot exchange rates are U.S. $0.78493 per Canadian dollar. What is the end-of-year profit or loss on the bank's cash position if in one year both Canadian bond rates increase to 7.5% and the exchange rate falls to U.S. $0.765 per Canadian dollar? (Assume no change in U.S. interest rates.) A Profit of U.S. $50,000 B Loss of U.S. $12,000 C Loss of U.S. $80,000 D Loss of CAD 119,000 E Profit of CAD 9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts