Question: A US based client has been investing in cryptocurrencies and cryptocurrency related assets over the last couple of years. They currently have a portfolio of

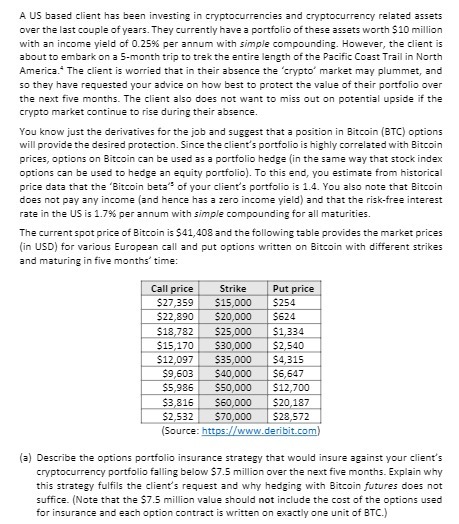

A US based client has been investing in cryptocurrencies and cryptocurrency related assets over the last couple of years. They currently have a portfolio of these assets worth $10 million with an income yield of 0.25%% per annum with simple compounding. However, the client is about to embark on a 5-month trip to trek the entire length of the Pacific Coast Trail in North America." The client is worried that in their absence the 'crypto' market may plummet, and so they have requested your advice on how best to protect the value of their portfolio over the next five months. The client also does not want to miss out on potential upside if the crypto market continue to rise during their absence. You know just the derivatives for the job and suggest that a position in Bitcoin (BTC) options will provide the desired protection. Since the client's portfolio is highly correlated with Bitcoin prices, options on Bitcoin can be used as a portfolio hedge (in the same way that stock index options can be used to hedge an equity portfolio). To this end, you estimate from historical price data that the 'Bitcoin beta" of your client's portfolio is 1.4. You also note that Bitcoin does not pay any income (and hence has a zero income yield) and that the risk-free interest rate in the US is 1.7%% per annum with simple compounding for all maturities. The current spot price of Bitcoin is $41,408 and the following table provides the market prices (in USD) for various European call and put options written on Bitcoin with different strikes and maturing in five months' time: Call price Strike Put price $27,359 $15,000 $254 $22,890 $20,000 $624 $18,782 $25,000 $1,334 $15,170 $30,000 $2,540 $12,097 535,000 $4,315 $9,603 $40,000 $6,647 $5,986 $50,000 $12,700 $3,816 $60,000 $20,187 $2,532 $70,000 $28,572 (Source: https://www.deribit.com) (=) Describe the options portfolio insurance strategy that would insure against your client's cryptocurrency portfolio falling below $7.5 million over the next five months. Explain why this strategy fulfils the client's request and why hedging with Bitcoin futures does not suffice. (Note that the $7.5 million value should not include the cost of the options used for insurance and each option contract is written on exactly one unit of BTC.)