Question: A U.S. company is considering a high technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign

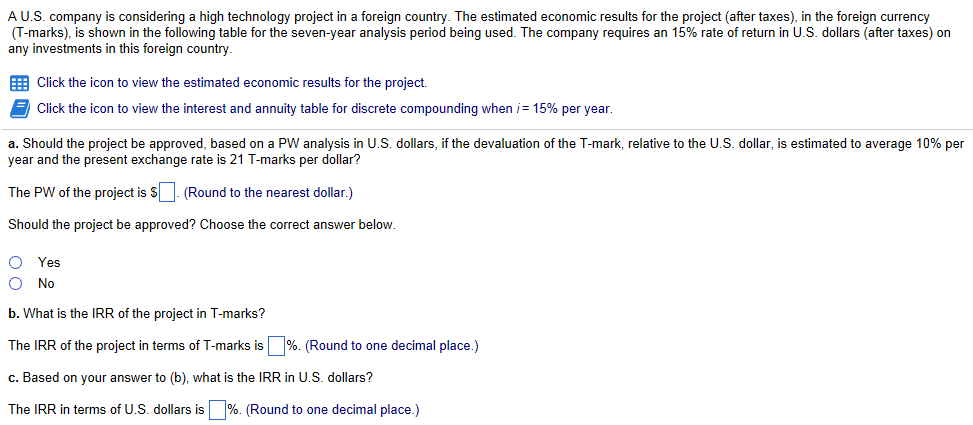

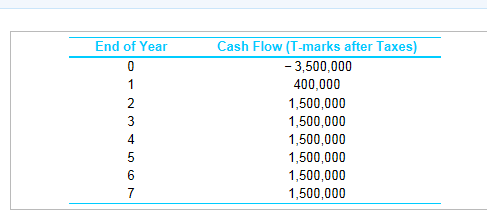

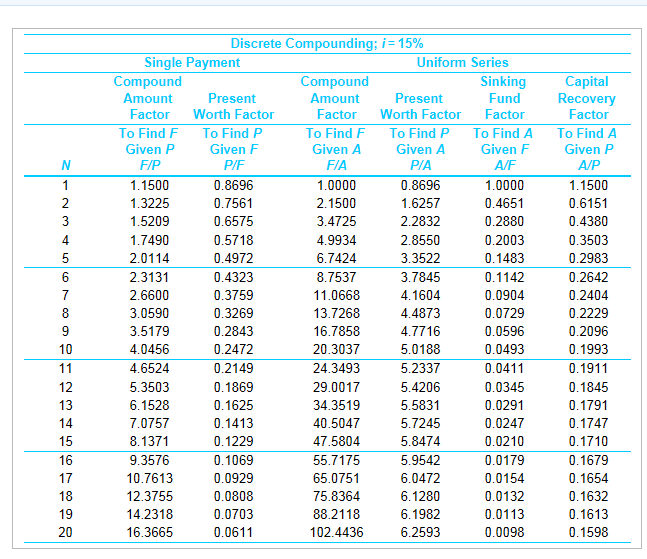

A U.S. company is considering a high technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency T marks), s shown in the follow ngtable for the seven-year analysis per d being used. The company requires an 15% rate ofre in U dollars after taxes on any investments in this foreign country. Click the icon to view the estimated economic results for the project. Click the icon to view the interest and annuity table for discrete compounding when ,-15% per year a. Should the project be approved, based on a PW analysis in US dollars if the devaluation of the T mark, relative to the US dollar is estimated to average 10% per year and the present exchange rate is 21 T-marks per dollar? The PW of the project is (Round to the nearest dollar.) Should the project be approved? Choose the correct answer below. O Yes O No b. What is the IRR of the project in T-marks? The IRR of the project in terms of T marks is % (Round to one decimal place ) c. Based on your answer to (b), what is the IRR in U.S. dollars? The IRR in terms of U.S. dollars is%. (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts