Question: a. Use the data in Table 9.3 to compute a five-day moving average for Computers, Inc. (Do not round intermediate calculations. Round your answers to

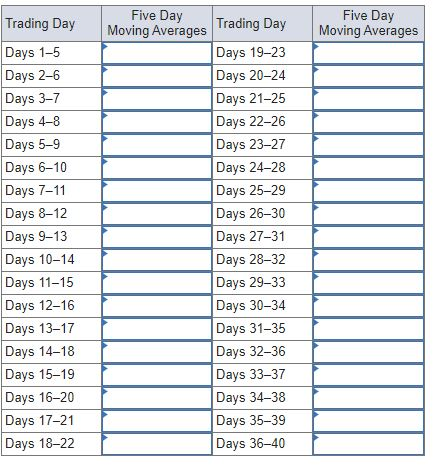

a. Use the data in Table 9.3 to compute a five-day moving average for Computers, Inc. (Do not round intermediate calculations. Round your answers to 3 decimal places.)

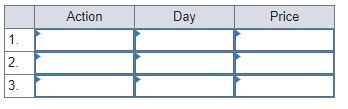

b. Identify buy or sell signals indicating the day on which such signals are identified. Also indicate buying or selling price. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

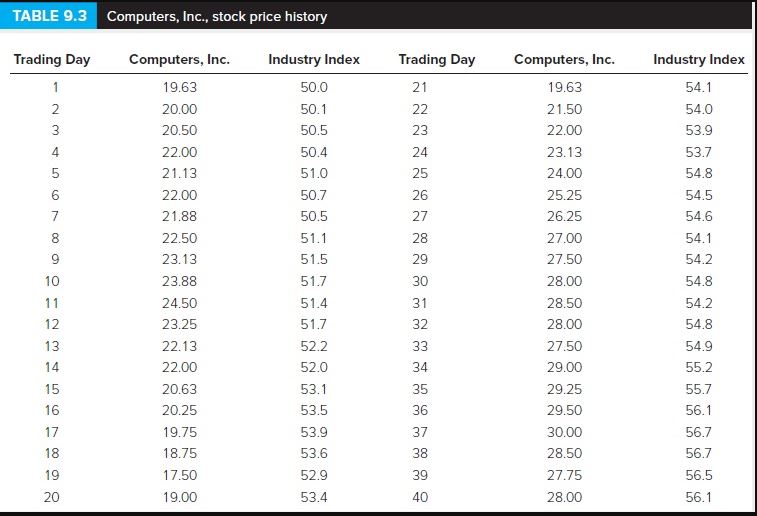

TABLE 9.3 Computers, Inc., stock price history Trading Day Trading Day 21 Industry Index 54.1 22 54.0 2 3 4 23 24 25 26 5 6 7 27 8 9 10 Computers, Inc. 19.63 20.00 20.50 22.00 21.13 22.00 21.88 22.50 23.13 23.88 24.50 23.25 22.13 22.00 20.63 20.25 19.75 18.75 17.50 19.00 Industry Index 50.0 50.1 50.5 50.4 51.0 50.7 50.5 51.1 51.5 51.7 51.4 51.7 522 52.0 53.1 53.5 53.9 53.6 52.9 53.4 Computers, Inc. 19.63 21.50 22.00 23.13 24.00 25.25 26.25 27.00 27.50 28.00 28.50 28.00 27.50 29.00 29.25 29.50 30.00 28.50 27.75 28.00 28 29 30 31 32 33 34 35 11 12 13 14 15 16 17 53.9 53.7 54.8 54.5 54.6 54.1 54.2 54.8 54.2 54.8 54.9 55.2 55.7 56.1 56.7 56.7 56.5 56.1 36 18 37 38 39 40 19 20 Five Day Moving Averages Trading Day Days 1-5 Days 2-6 Days 3-7 Days 4-8 Days 5-9 Days 6-10 Days 7-11 Days 8-12 Days 9-13 Days 10-14 Days 11-15 Days 12-16 Days 13-17 Days 14-18 Days 15-19 Days 16-20 Days 17-21 Days 18-22 Five Day Moving Averages Trading Day Days 19-23 Days 20-24 Days 21-25 Days 22-26 Days 23-27 Days 24-28 Days 25-29 Days 26-30 Days 27-31 Days 28-32 Days 29-33 Days 30-34 Days 31-35 Days 32-36 Days 33-37 Days 34-38 Days 35-39 Days 36-40 Action Day Price 1. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts