Question: A) Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of changes in equity and a classified statement of

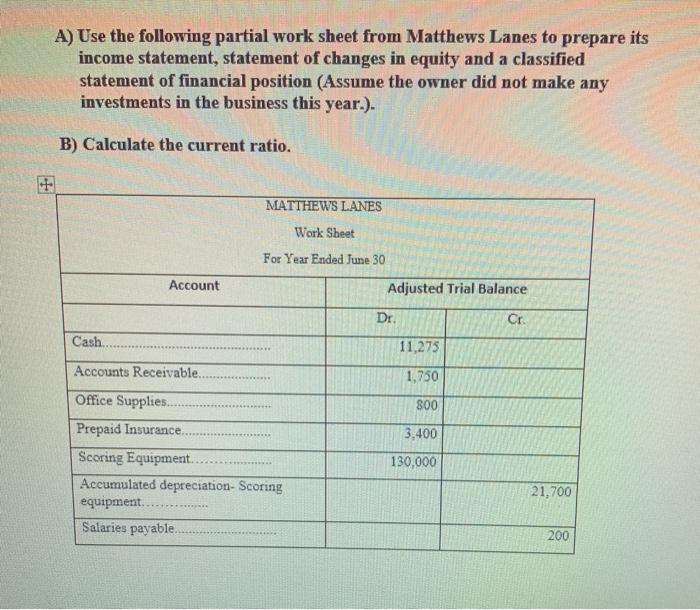

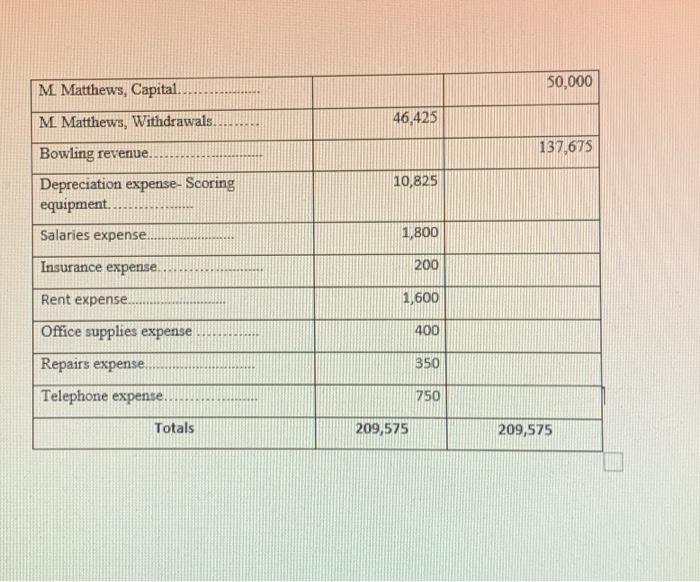

A) Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of changes in equity and a classified statement of financial position (Assume the owner did not make any investments in the business this year.). B) Calculate the current ratio. MATTHEWS LANES Work Sheet For Year Ended June 30 Account Adjusted Trial Balance Dr. Cr Cash 11,275 Accounts Receivable. 1,750 800 3,400 Office Supplies... Prepaid Insurance Scoring Equipment.. Accumulated depreciation- Scoring equipment. Salaries payable. 130,000 21,700 200 50,000 146,425 M Matthews, Capital. M Matthews, Withdrawals. Bowling revenue. Depreciation expense- Scoring equipment. 137,675 10,825 Salaries expense 1,800 Insurance expense. 200 Rent expense. 1,600 Office supplies expense 400 Repairs expense 350 Telephone expense 750 Totals 209,575 209,575

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts