Question: a. Use the given data to create a Heugt ug b. Assume that interest rates in general increase by 200 basis points. How w did

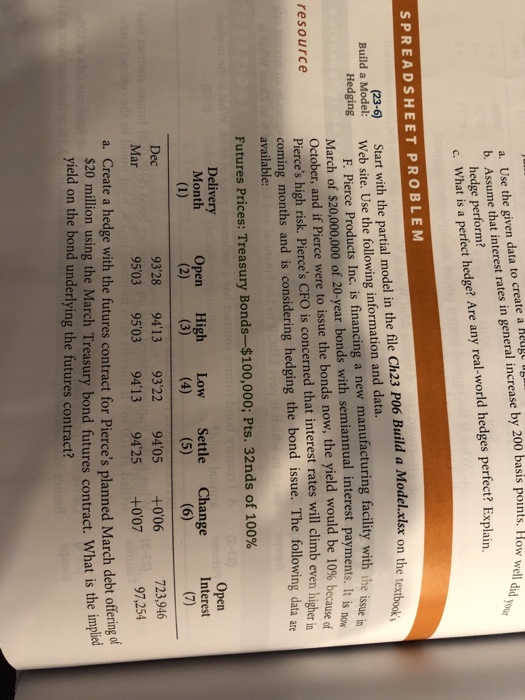

a. Use the given data to create a Heugt ug b. Assume that interest rates in general increase by 200 basis points. How w did you hedge perform? c hat is erect hedget Are any real-world hedges perfect Explain. SPREADSHEET PROBLEM (23-6 Start with the partial model in the file Ch23 P06 Build a Model.xilsx on the Build a Model: Hedging Web site. Use the following information and data. F. Pierce Products Inc. is financing a new manufacturing facility with the iste March of $20,000,000 of 20-year bonds with semiannual interest payments. It is oc October, and if Pierce were to issue the bonds now, the yield would be 10% because Pierce's high risk. Pierce's CFO is concerned that interest rates will climb even higher coming months and is considering hedging the bond issue. The available: of resource following data are Futures Prices: Treasury Bonds-$100,000; Pts. 32nds of 100% Delivery Month Open Open High Low Settle Change Interest 723,946 97,254 93'28 9413 93'22 94'05 +006 9503 9503 94'13 94'25 +007 a. Create a hedge with the futures contract for Pierce's planned March debt offering $20 million using the March Treasury bond futures contract. What is the impliea Dec Mar yield on the bond underlying the futures contract? a. Use the given data to create a Heugt ug b. Assume that interest rates in general increase by 200 basis points. How w did you hedge perform? c hat is erect hedget Are any real-world hedges perfect Explain. SPREADSHEET PROBLEM (23-6 Start with the partial model in the file Ch23 P06 Build a Model.xilsx on the Build a Model: Hedging Web site. Use the following information and data. F. Pierce Products Inc. is financing a new manufacturing facility with the iste March of $20,000,000 of 20-year bonds with semiannual interest payments. It is oc October, and if Pierce were to issue the bonds now, the yield would be 10% because Pierce's high risk. Pierce's CFO is concerned that interest rates will climb even higher coming months and is considering hedging the bond issue. The available: of resource following data are Futures Prices: Treasury Bonds-$100,000; Pts. 32nds of 100% Delivery Month Open Open High Low Settle Change Interest 723,946 97,254 93'28 9413 93'22 94'05 +006 9503 9503 94'13 94'25 +007 a. Create a hedge with the futures contract for Pierce's planned March debt offering $20 million using the March Treasury bond futures contract. What is the impliea Dec Mar yield on the bond underlying the futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts