Question: a. Using a 40/60 split, what is the weighted average standard deviation of the two stocks? b. Recalculate the standard deviation of a portfolio of

a. Using a 40/60 split, what is the weighted average standard deviation of the two stocks?

a. Using a 40/60 split, what is the weighted average standard deviation of the two stocks?

b. Recalculate the standard deviation of a portfolio of the two stocks

c. What is the reduction in standard deviation that results from the creation of a portfolio of the two stocks?

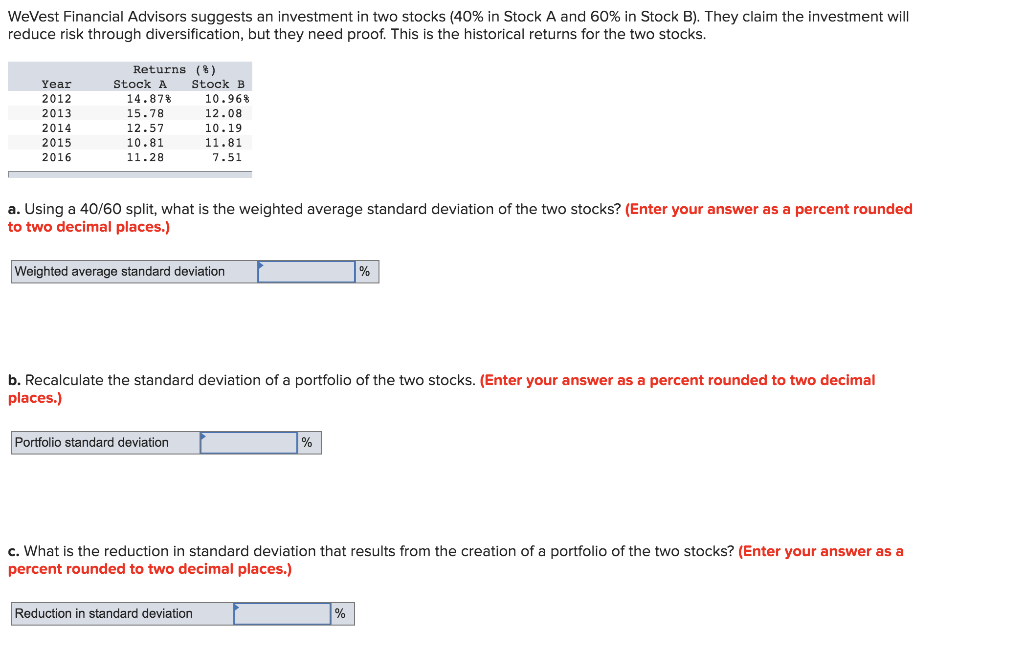

WeVest Financial Advisors suggests an investment in two stocks (40% in Stock A and 60% in Stock B). They claim the investment will reduce risk through diversification, but they need proof. This is the historical returns for the two stocks. Year 2012 2013 2014 2015 2016 Returns (%) Stock A Stock B 14.87% 10.96% 15.78 12.08 12.57 10.19 10.81 11.81 11.28 7.51 a. Using a 40/60 split, what is the weighted average standard deviation of the two stocks? (Enter your answer as a percent rounded to two decimal places.) Weighted average standard deviation b. Recalculate the standard deviation of a portfolio of the two stocks. (Enter your answer as a percent rounded to two decimal places.) Portfolio standard deviation c. What is the reduction in standard deviation that results from the creation of a portfolio of the two stocks? (Enter your answer as a percent rounded to two decimal places.) Reduction in standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts