Question: a. Using current IRC $448,' determine whether Squawk Box is required to change from the cash method to the accrual method for 2018 or 2019

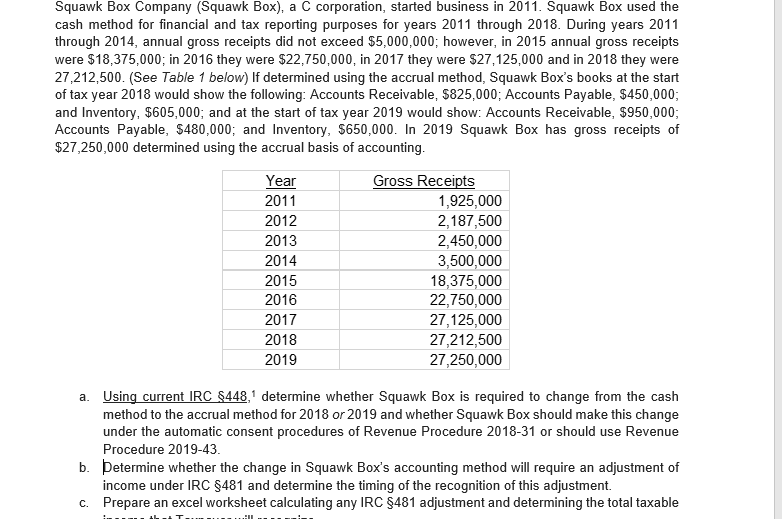

a. Using current IRC $448,' determine whether Squawk Box is required to change from the cash method to the accrual method for 2018 or 2019 and whether Squawk Box should make this change under the automatic consent procedures of Revenue Procedure 2018-31 or should use Revenue Procedure 2019-43. b. Determine whether the change in Squawk Box's accounting method will require an adjustment of income under IRC $481 and determine the timing of the recognition of this adjustment. C. Prepare an excel worksheet calculating any IRC $481 adjustment and determining the total taxable income that Taxpayer will recognize. d. Prepare Form 3115, referring to forms and instructions available at http://www.irs.gov. Be sure to also follow instructions in the materials provided on Blackboard. e. Draft a tax memorandum to Martin Bear, Partner at Bull & Bear, with the results of your research and suggestions. Attach the ocuments you have prepared. The memorandum itself ould be no longer than three single-spaced pages in length. Reference aids: 1. IRC $448 2. IRC $481; 3. Revenue Procedures 2018-31 and 2019-43; and a. Using current IRC $448,' determine whether Squawk Box is required to change from the cash method to the accrual method for 2018 or 2019 and whether Squawk Box should make this change under the automatic consent procedures of Revenue Procedure 2018-31 or should use Revenue Procedure 2019-43. b. Determine whether the change in Squawk Box's accounting method will require an adjustment of income under IRC $481 and determine the timing of the recognition of this adjustment. C. Prepare an excel worksheet calculating any IRC $481 adjustment and determining the total taxable income that Taxpayer will recognize. d. Prepare Form 3115, referring to forms and instructions available at http://www.irs.gov. Be sure to also follow instructions in the materials provided on Blackboard. e. Draft a tax memorandum to Martin Bear, Partner at Bull & Bear, with the results of your research and suggestions. Attach the ocuments you have prepared. The memorandum itself ould be no longer than three single-spaced pages in length. Reference aids: 1. IRC $448 2. IRC $481; 3. Revenue Procedures 2018-31 and 2019-43; and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts