Question: a. Using information in the financial statements as originally reported in Exhibits 6.27-6.29, compute the value of Beneish's manipulation index for fiscal Year 5 and

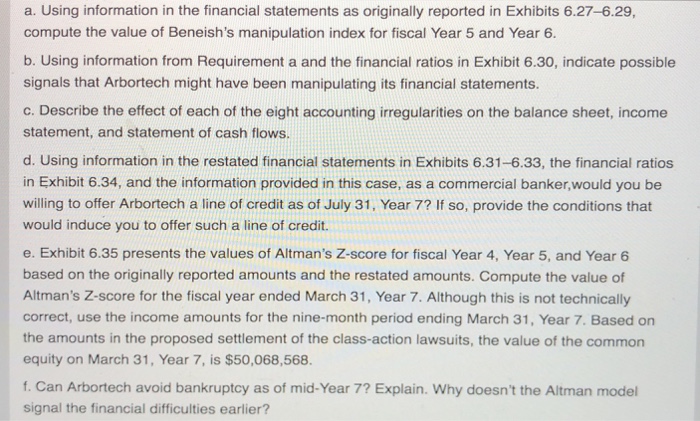

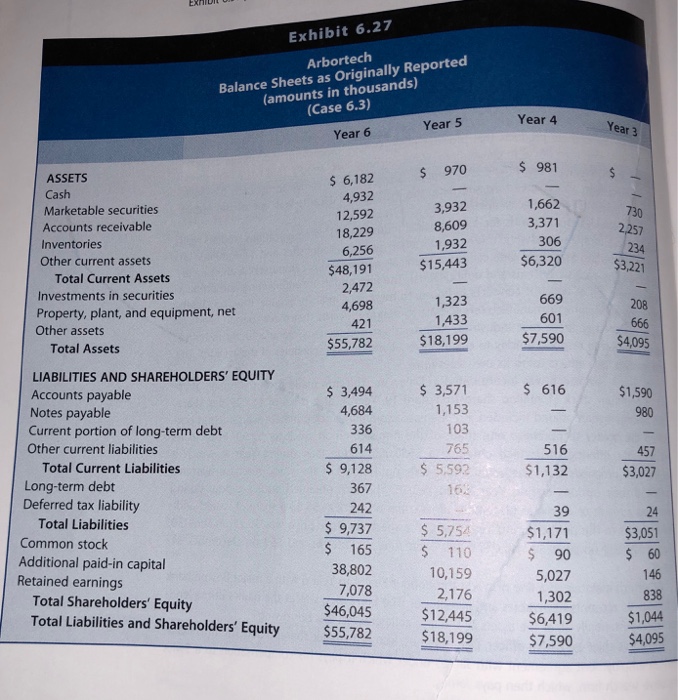

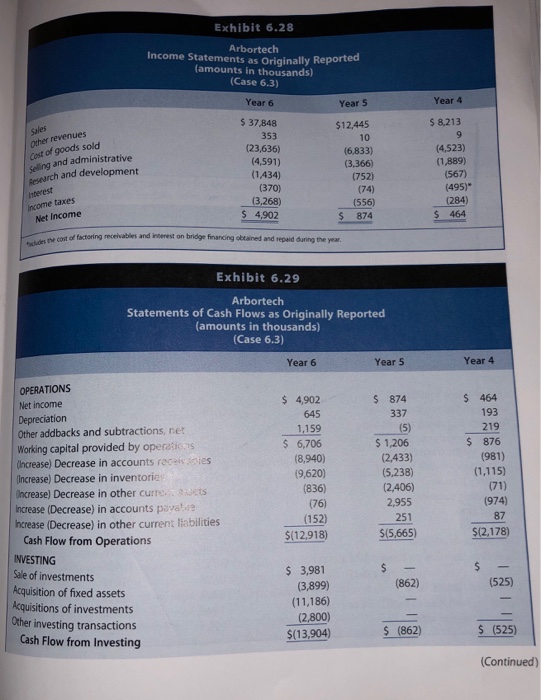

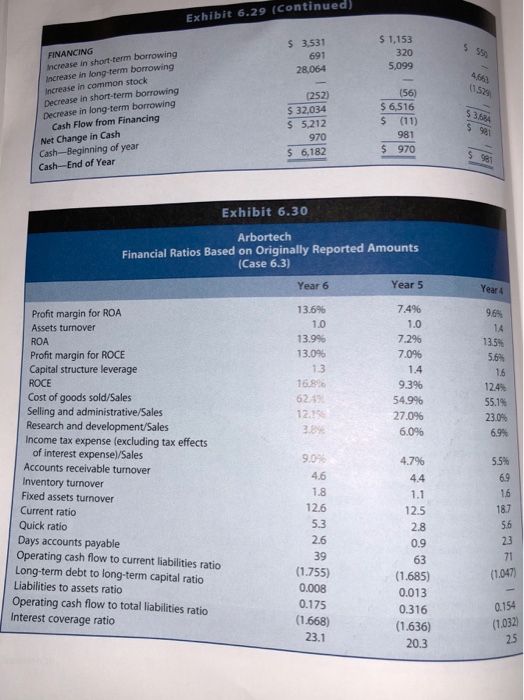

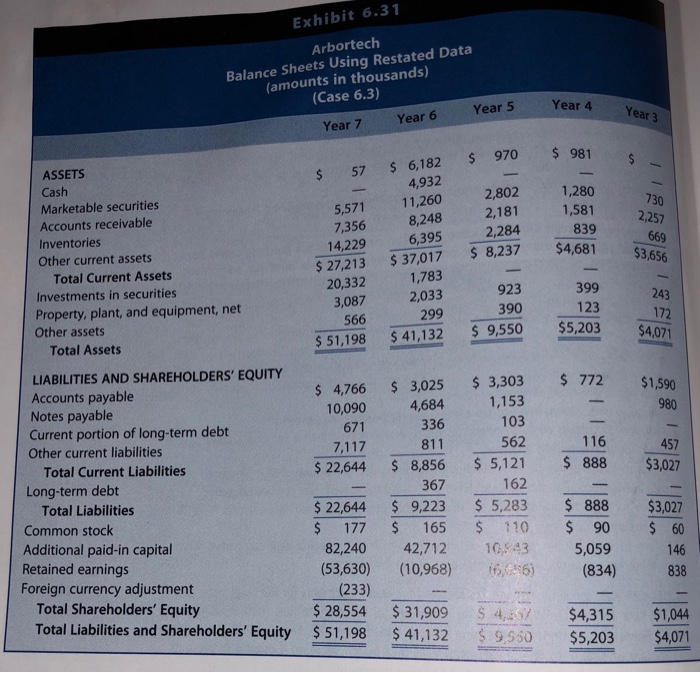

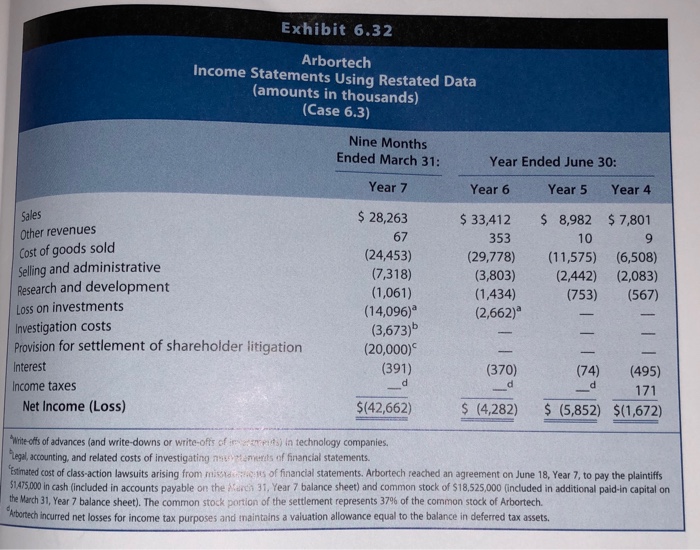

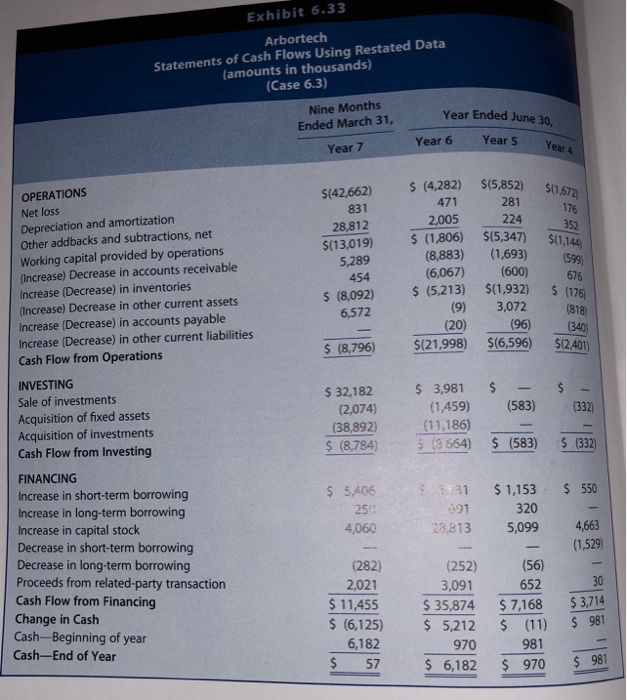

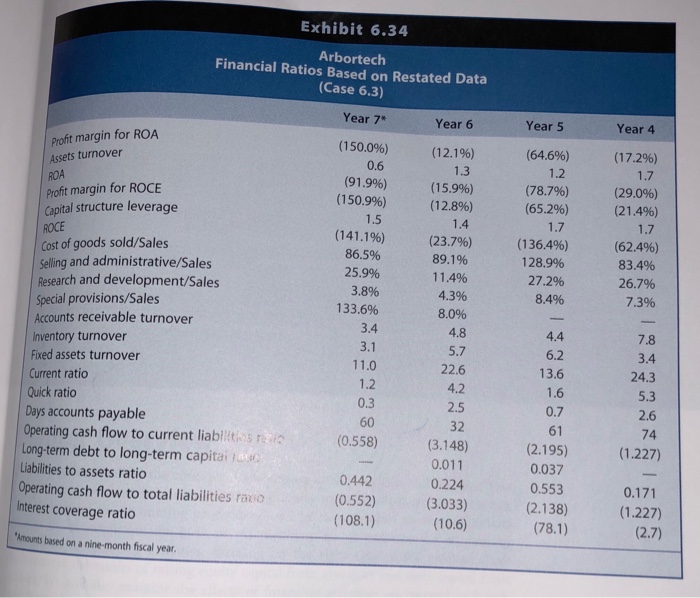

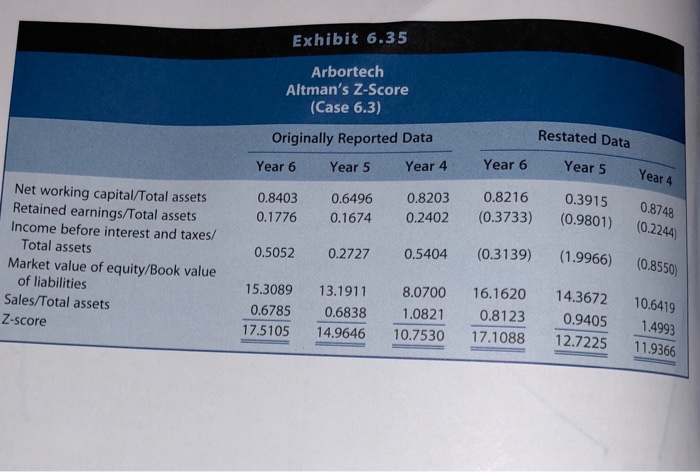

a. Using information in the financial statements as originally reported in Exhibits 6.27-6.29, compute the value of Beneish's manipulation index for fiscal Year 5 and Year 6 b. Using information from Requirement a and the financial ratios in Exhibit 6.30, indicate possible signals that Arbortech might have been manipulating its financial statements. c. Describe the effect of each of the eight accounting irregularities on the balance sheet, income statement, and statement of cash flows d. Using information in the restated financial statements in Exhibits 6.31-6.33, the financial ratios in Exhibit 6.34, and the information provided in this case, as a commercial banker,would you be willing to offer Arbortech a line of credit as of July 31, Year 7? If so, provide the conditions that would induce you to offer such a line of credit. e. Exhibit 6.35 presents the values of Altman's Z-score for fiscal Year 4, Year 5, and Year 6 based on the originally reported amounts and the restated amounts. Compute the value of Altman's Z-score for the fiscal year ended March 31, Year 7. Although this is not technically correct, use the income amounts for the nine-month period ending March 31, Year 7. Based on the amounts in the proposed settlement of the class-action lawsuits, the value of the common equity on March 31, Year 7, is $50,068,568. f. Can Arbortech avoid bankruptcy as of mid-Year 7? Explain. Why doesn't the Altman model signal the financial difficulties earlier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts