Question: (a) Using R, estimate the relationship between trading volume (Vol) as the dependent variable and the value of the S&P 500 index as the independent

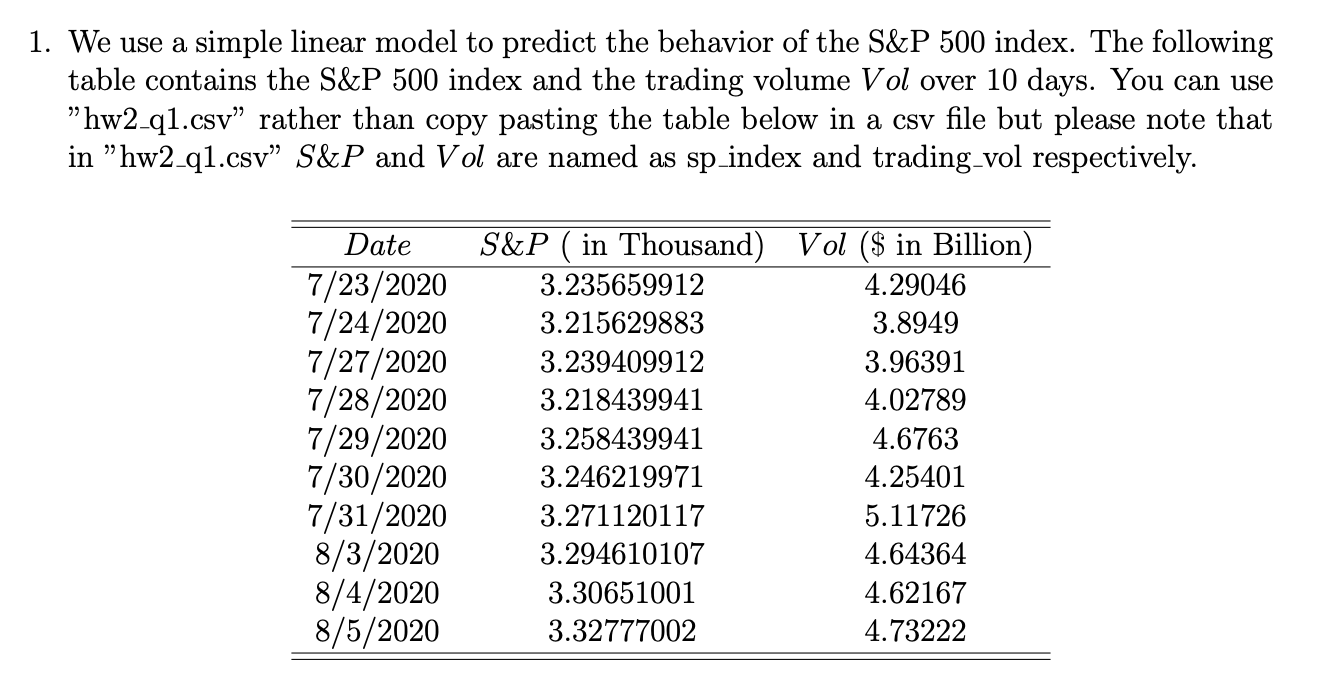

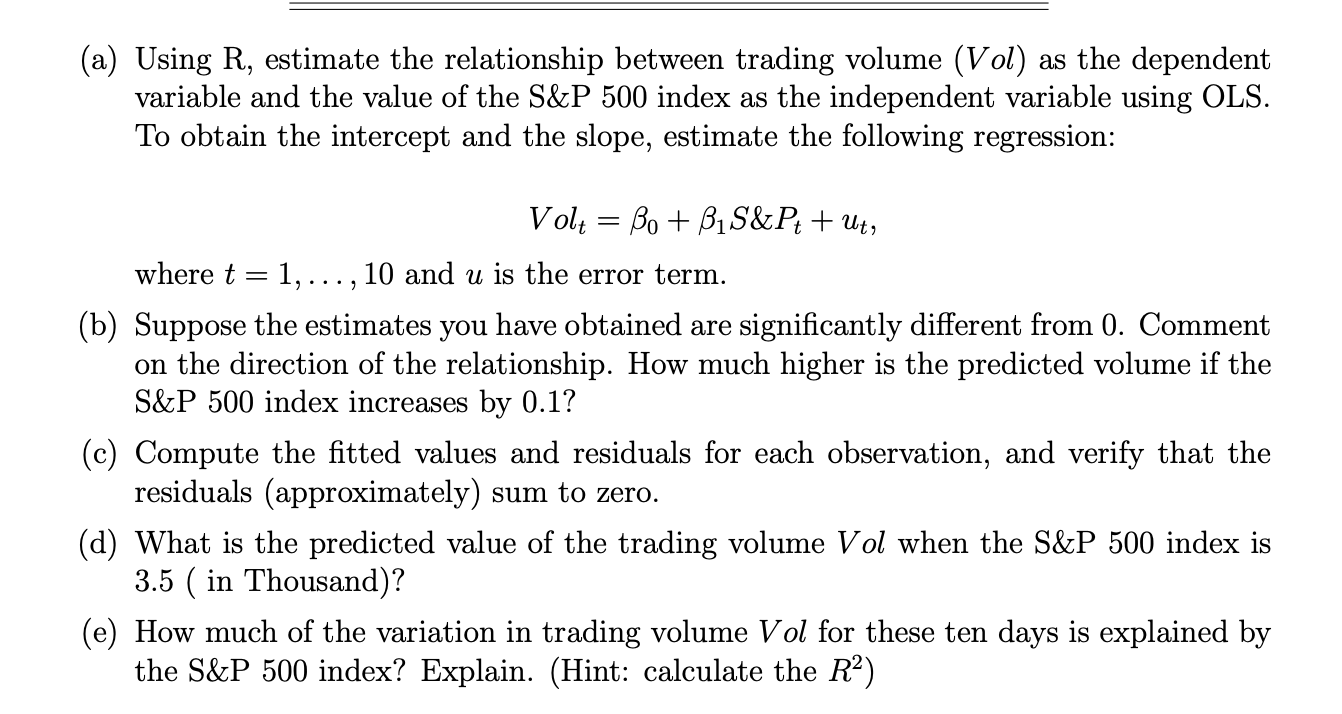

(a) Using R, estimate the relationship between trading volume (Vol) as the dependent variable and the value of the S\&P 500 index as the independent variable using OLS. To obtain the intercept and the slope, estimate the following regression: Volt=0+1S&Pt+ut where t=1,,10 and u is the error term. (b) Suppose the estimates you have obtained are significantly different from 0. Comment on the direction of the relationship. How much higher is the predicted volume if the S\&P 500 index increases by 0.1 ? (c) Compute the fitted values and residuals for each observation, and verify that the residuals (approximately) sum to zero. (d) What is the predicted value of the trading volume Vol when the S\&P 500 index is 3.5 ( in Thousand)? (e) How much of the variation in trading volume Vol for these ten days is explained by the S\&P 500 index? Explain. (Hint: calculate the R2 ) (a) Using R, estimate the relationship between trading volume (Vol) as the dependent variable and the value of the S\&P 500 index as the independent variable using OLS. To obtain the intercept and the slope, estimate the following regression: Volt=0+1S&Pt+ut where t=1,,10 and u is the error term. (b) Suppose the estimates you have obtained are significantly different from 0. Comment on the direction of the relationship. How much higher is the predicted volume if the S\&P 500 index increases by 0.1 ? (c) Compute the fitted values and residuals for each observation, and verify that the residuals (approximately) sum to zero. (d) What is the predicted value of the trading volume Vol when the S\&P 500 index is 3.5 ( in Thousand)? (e) How much of the variation in trading volume Vol for these ten days is explained by the S\&P 500 index? Explain. (Hint: calculate the R2 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts