Question: a) Using the 2019 actual data provided in the Schedule 1 and the assumptions provided in 2020 Budget Assumptions worksheet of the student workbook, complete

a) Using the 2019 actual data provided in the Schedule 1 and the assumptions provided in 2020 Budget Assumptions worksheet of the student workbook, complete a budget for T&K Taxation for the year ending 31 December 2020. Assuming the budget is phased evenly over the 12 months.

Please tell me how to calculate

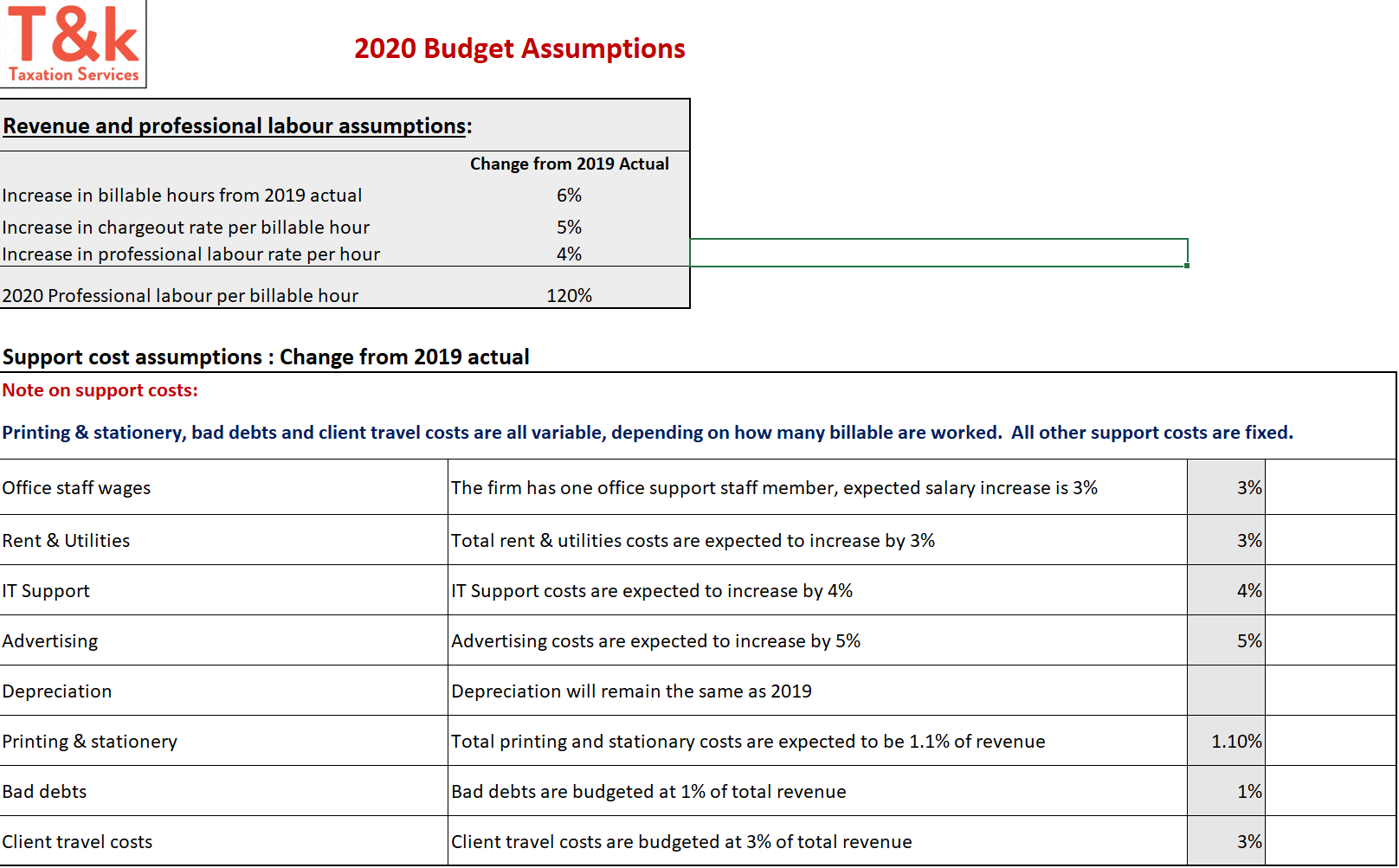

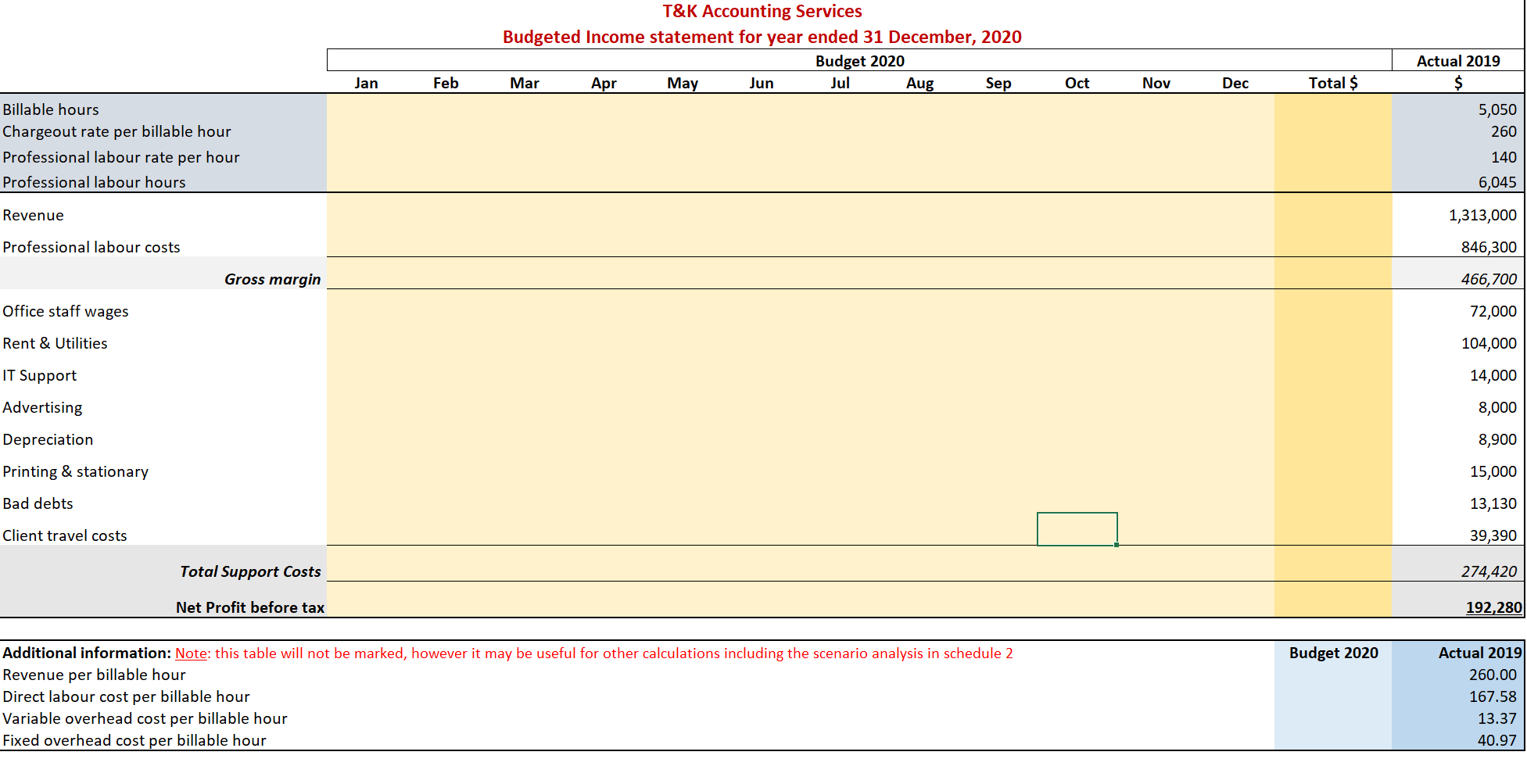

T&K 2020 Budget Assumptions Taxation Services Revenue and professional labour assumptions: Increase in billable hours from 2019 actual Increase in chargeout rate per billable hour Increase in professional labour rate per hour Change from 2019 Actual 6% 5% 4% 2020 Professional labour per billable hour 120% Support cost assumptions : Change from 2019 actual Note on support costs: Printing & stationery, bad debts and client travel costs are all variable, depending on how many billable are worked. All other support costs are fixed. Office staff wages The firm has one office support staff member, expected salary increase is 3% 3% Rent & Utilities Total rent & utilities costs are expected to increase by 3% 3% IT Support IT Support costs are expected to increase by 4% Advertising Advertising costs are expected to increase by 5% 5% Depreciation Depreciation will remain the same as 2019 Printing & stationery Total printing and stationary costs are expected to be 1.1% of revenue 1.10% Bad debts Bad debts are budgeted at 1% of total revenue 1% Client travel costs Client travel costs are budgeted at 3% of total revenue 3% T&K Accounting Services Budgeted Income statement for year ended 31 December, 2020 Budget 2020 Mar Apr May Jun Jul Aug Sep Jan Feb Oct Nov Dec Total $ Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours Actual 2019 $ 5,050 260 140 6,045 Revenue 1,313,000 Professional labour costs 846,300 Gross margin 466,700 Office staff wages 72,000 Rent & Utilities 104,000 14,000 8,000 IT Support Advertising Depreciation Printing & stationary 8,900 15,000 Bad debts 13,130 39,390 Client travel costs Total Support Costs 274,420 Net Profit before tax 192,280 Budget 2020 Additional information: Note: this table will not be marked, however it may be useful for other calculations including the scenario analysis in schedule 2 Revenue per billable hour Direct labour cost per billable hour Variable overhead cost per billable hour Fixed overhead cost per billable hour Actual 2019 260.00 167.58 13.37 40.97 T&K 2020 Budget Assumptions Taxation Services Revenue and professional labour assumptions: Increase in billable hours from 2019 actual Increase in chargeout rate per billable hour Increase in professional labour rate per hour Change from 2019 Actual 6% 5% 4% 2020 Professional labour per billable hour 120% Support cost assumptions : Change from 2019 actual Note on support costs: Printing & stationery, bad debts and client travel costs are all variable, depending on how many billable are worked. All other support costs are fixed. Office staff wages The firm has one office support staff member, expected salary increase is 3% 3% Rent & Utilities Total rent & utilities costs are expected to increase by 3% 3% IT Support IT Support costs are expected to increase by 4% Advertising Advertising costs are expected to increase by 5% 5% Depreciation Depreciation will remain the same as 2019 Printing & stationery Total printing and stationary costs are expected to be 1.1% of revenue 1.10% Bad debts Bad debts are budgeted at 1% of total revenue 1% Client travel costs Client travel costs are budgeted at 3% of total revenue 3% T&K Accounting Services Budgeted Income statement for year ended 31 December, 2020 Budget 2020 Mar Apr May Jun Jul Aug Sep Jan Feb Oct Nov Dec Total $ Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours Actual 2019 $ 5,050 260 140 6,045 Revenue 1,313,000 Professional labour costs 846,300 Gross margin 466,700 Office staff wages 72,000 Rent & Utilities 104,000 14,000 8,000 IT Support Advertising Depreciation Printing & stationary 8,900 15,000 Bad debts 13,130 39,390 Client travel costs Total Support Costs 274,420 Net Profit before tax 192,280 Budget 2020 Additional information: Note: this table will not be marked, however it may be useful for other calculations including the scenario analysis in schedule 2 Revenue per billable hour Direct labour cost per billable hour Variable overhead cost per billable hour Fixed overhead cost per billable hour Actual 2019 260.00 167.58 13.37 40.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts