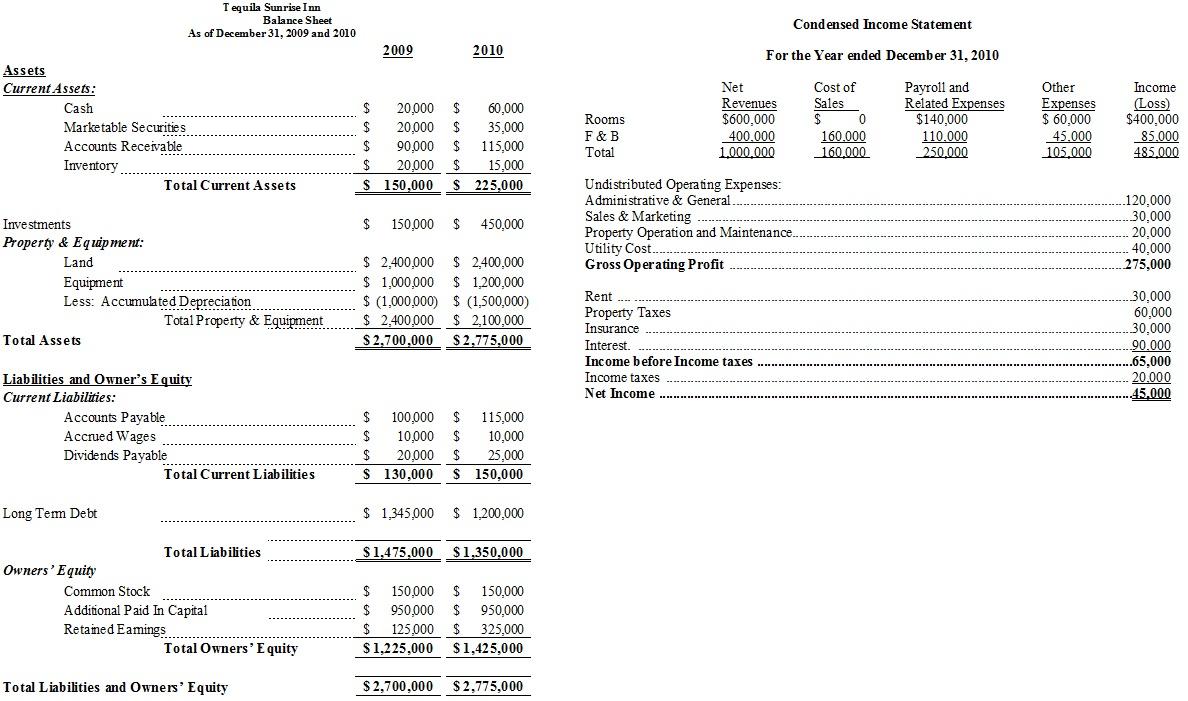

Question: A. Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given, What is the Debt-to-Equity ratio on 12/31/2010 ? Group of answer

A. Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given,

What is the Debt-to-Equity ratio on 12/31/2010?

Group of answer choices

0.647

0.947

0.847

0.747

Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given,

B. What is the Profit Margin?

Group of answer choices

5.5%

6.5%

4.5%

3.5%

Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given,

C. What is the Return on Equity?

Group of answer choices

3.39%

4.39%

5.39%

2.39%

Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given,

D. What is the Quick Ratio on 12/31/2010?

Group of answer choices

1.5

1.4

1.7

1.6

Using the Balance Sheet and Income Statement for the Tequila Sunrise Inn given,

E. What is the Number of Times Interest Earned ratio?

Group of answer choices

1.52

1.72

1.62

1.82

Using the income statement of Tequila Sunrise Inn, answer the following:

F. Which cost(s) is/are purely variable cost(s)?

Group of answer choices

Property Operations & Maintenance

Payroll

Cost of Sales

Payroll & Cost of Sales

Using the income statement of Tequila Sunrise Inn, answer the following:

G. What is the total of the direct expenses of the F&B department?

Group of answer choices

$155,000

$160,000

$270,000

$315,000

Using the income statement of Tequila Sunrise Inn, answer the following:

H. Which group of costs is part of the fixed costs?

Group of answer choices

Rent, Utility

Rent, Property Tax, Insurance, Interest Expense

Rent, Property Tax, Insurance, Maintenance

Rent, Property tax, Maintenance

Using the income statement of Tequila Sunrise Inn, answer the following:

I. What is the total of the fixed costs for the period?

Group of answer choices

$150,000

$120,000

$90,000

$210,000

Using the income statement of Tequila Sunrise Inn, answer the following:

J. Which group of costs is part of the overhead costs?

Group of answer choices

Rent, Property taxes, Insurance, Interest Expense, Cost of Sales, Payroll

A&G, Sales & marketing, Maintenance

Rent, Property taxes, Insurance, Interest Expense, Payroll

Rent, Property taxes, Insurance, Interest Expense, Cost of Sales

Using the income statement of Tequila Sunrise Inn, answer the following:

K. What is the total of the overhead costs for the period?

Group of answer choices

$210,000

$440,000

$410,000

$240,000

Condensed Income Statement For the Year ended December 31,2010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts