Question: A. Using the Final Project Excel Workbook, compute the following time value of money figures: 1. Calculate the present value of the company based on

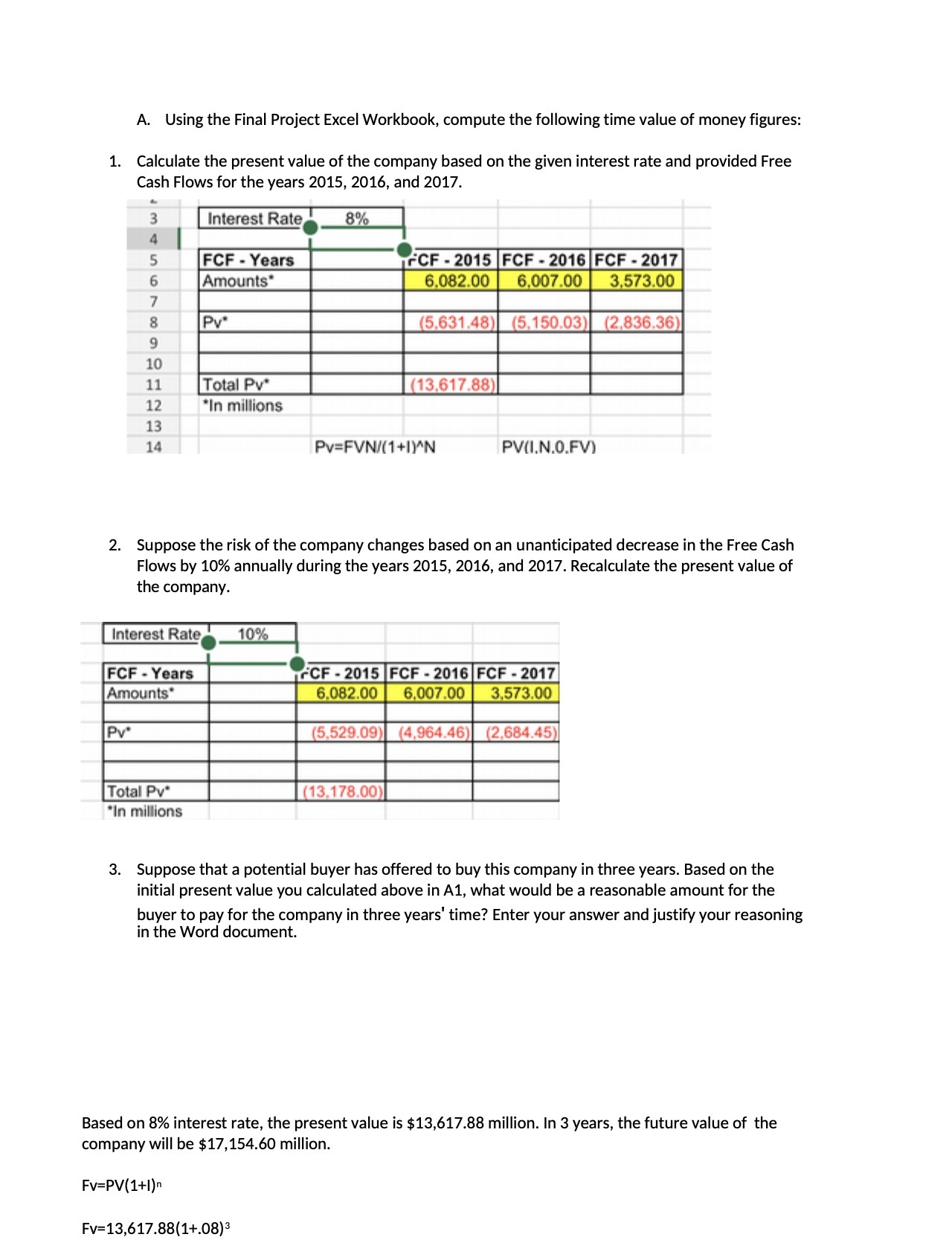

A. Using the Final Project Excel Workbook, compute the following time value of money figures: 1. Calculate the present value of the company based on the given interest rate and provided Free Cash Flows for the years 2015, 2016, and 2017. W Interest Rate 8% 4 5 FCF - Years FCF - 2015 FCF - 2016 FCF - 2017 6 Amounts 6.082.00 6,007.00 3.573.00 7 8 Pv* (5.631.48) (5. 150.03) (2.836.36) 9 10 11 Total Pv* (13,617.88) 12 "In millions 13 14 Pv=FVN/(1+1)^N PV(I.N.O.FV) 2. Suppose the risk of the company changes based on an unanticipated decrease in the Free Cash Flows by 10% annually during the years 2015, 2016, and 2017. Recalculate the present value of the company. Interest Rate 10% FCF - Years GCF - 2015 FCF - 2016 FCF - 2017 Amounts 6.082.00 6.007.00 3.573.00 Pv (5,529.09) (4,964.46)( (2,684.45) Total Pv* (13.178.00) "In millions 3. Suppose that a potential buyer has offered to buy this company in three years. Based on the initial present value you calculated above in A1, what would be a reasonable amount for the buyer to pay for the company in three years' time? Enter your answer and justify your reasoning in the Word document. Based on 8% interest rate, the present value is $13,617.88 million. In 3 years, the future value of the company will be $17,154.60 million. Fv=PV(1+1)n Fv=13,617.88(1+.08)3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts