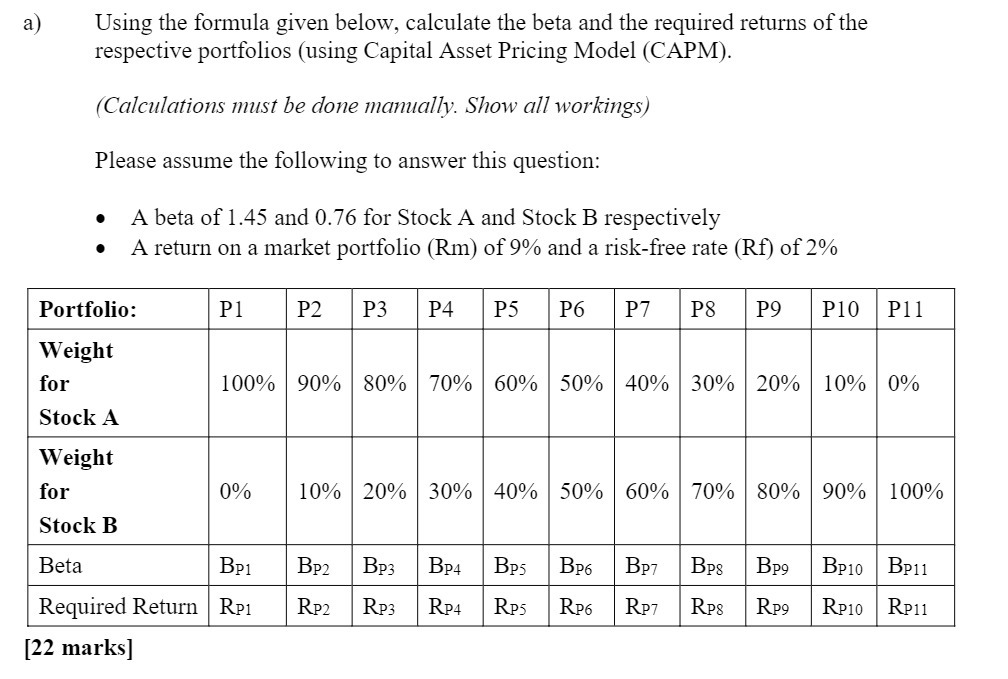

Question: a) Using the formula given below, calculate the beta and the required returns of the respective portfolios (using Capital Asset Pricing Model (CAPM). (Calculations

a) Using the formula given below, calculate the beta and the required returns of the respective portfolios (using Capital Asset Pricing Model (CAPM). (Calculations must be done manually. Show all workings) Please assume the following to answer this question: A beta of 1.45 and 0.76 for Stock A and Stock B respectively A return on a market portfolio (Rm) of 9% and a risk-free rate (Rf) of 2% Portfolio: Weight for Stock A Weight for Stock B Beta P1 P2 P3 P4 P5 P6 P7 P8 P9 P10 P11 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% BP1 BP2 BP3 BP4 BP5 BP6 Required Return Rp1 RP2 Rp3 RP4 Rp5 RP6 [22 marks] Bp7 Bp8 Bp9 RP7 RPS Rp9 BP10 BP11 RP10 RP11

Step by Step Solution

There are 3 Steps involved in it

Here are the beta and required returns for each portfolio calculated using the Capi... View full answer

Get step-by-step solutions from verified subject matter experts