Question: a. Using the high-low method of cost analysis, determine the variable portion of the semi-variable cost per direct labor hour. Determine the total fixed

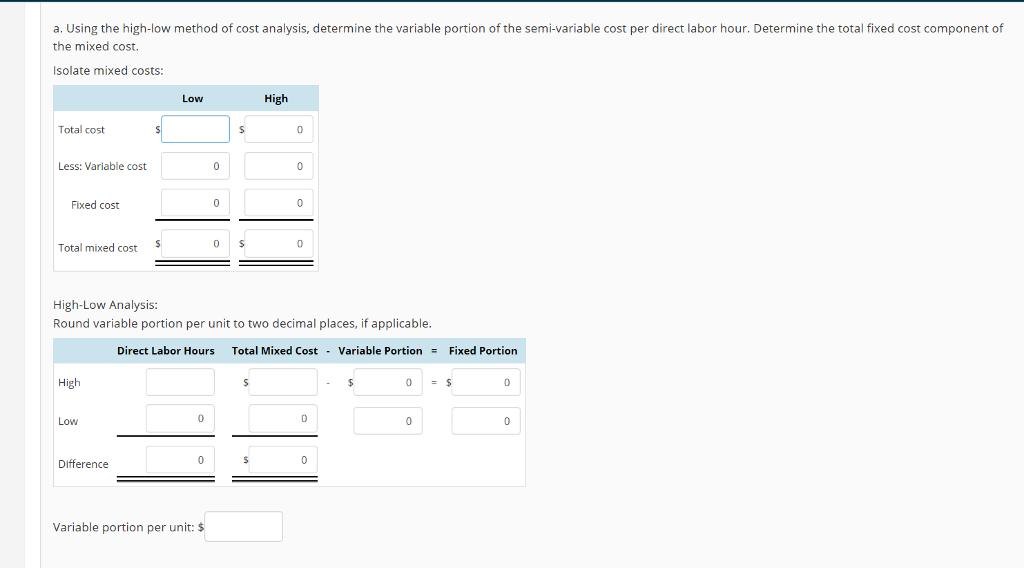

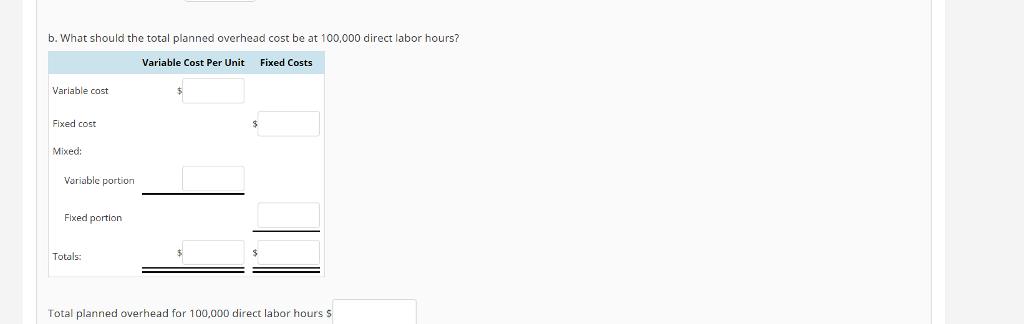

a. Using the high-low method of cost analysis, determine the variable portion of the semi-variable cost per direct labor hour. Determine the total fixed cost component of the mixed cost. Isolate mixed costs: Low High Total cost Less: Varlable cost Fixed cost Total mixed cost High-Low Analysis: Round variable portion per unit to two decimal places, if applicable. Direct Labor Hours Total Mixed Cost - Variable Portion = Fixed Portion High 24 Low Difference Variable portion per unit: $ b. What should the total planned overhead cost be at 100,000 direct labor hours? Variable Cost Per Unit Fixed Costs Variable cost Fixed cost Mixed: Variable portion Fixed portion Totals: Total planned overhead for 100,000 direct labor hours S

Step by Step Solution

There are 3 Steps involved in it

Answer Explanation Labor Hours 90000 130000 Low High Total cost 484000 628000 Less Variable cost 198... View full answer

Get step-by-step solutions from verified subject matter experts