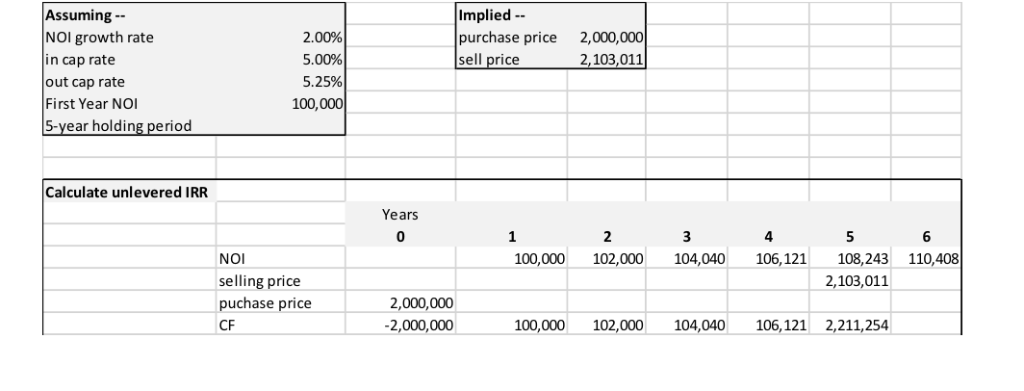

Question: A. Using the information below -- What is the expected unlevered total return for this property assuming a 5-year holding period. Next we will add

A. Using the information below -- What is the expected unlevered total return for this property assuming a 5-year holding period.

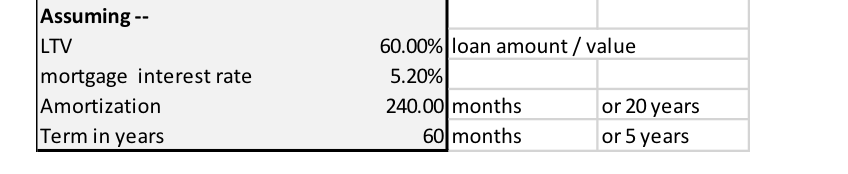

Next we will add debt (add a mortgage to the proforma)

B. What is the loan amount at origination?

C.What is the down payment?

D. What is the annual debt service?

E. What is the Outstanding Loan Balance at the end of the 5-Year holding period?

F. What is the net sale proceeds at the end of the 5-Year holding period?

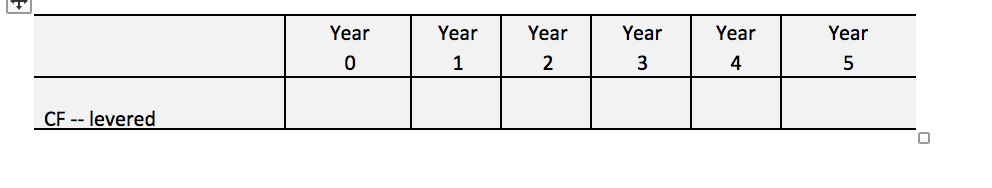

G.Write the levered property cash flows for the 5-Year holding period

H. What is the levered IRR or levered property return?

I. Do you have positive or negative leverage?

Assuming NOI growth rate in cap rate out cap rate First Year NOI 5-vear holding period Implied purchase price sell price 200% 5.00% 5.25% 100,000 2,000,000 2,103,011 Calculate unlevered IRR Years 0 1 4 5 NOI selling price puchase price CF 100,000 102,000 104,040 106,121 108,243 110,408 2,103,011 2,000,000 100,00002,000 104,040 106,121 2,211,254 Assuming LTV mortgage interest rate Amortization Term in years 60.00%) loan amount / value 5.20% 240.00 months or 20 years or 5 years 60 months Year 0) Year Year 4 Year 5 Year Year 2 CF--levered 0 Assuming NOI growth rate in cap rate out cap rate First Year NOI 5-vear holding period Implied purchase price sell price 200% 5.00% 5.25% 100,000 2,000,000 2,103,011 Calculate unlevered IRR Years 0 1 4 5 NOI selling price puchase price CF 100,000 102,000 104,040 106,121 108,243 110,408 2,103,011 2,000,000 100,00002,000 104,040 106,121 2,211,254 Assuming LTV mortgage interest rate Amortization Term in years 60.00%) loan amount / value 5.20% 240.00 months or 20 years or 5 years 60 months Year 0) Year Year 4 Year 5 Year Year 2 CF--levered 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts