Question: a) Using the information in the table below show how to execute a currency carry trade.(If you think you should borrow from the U.S. then

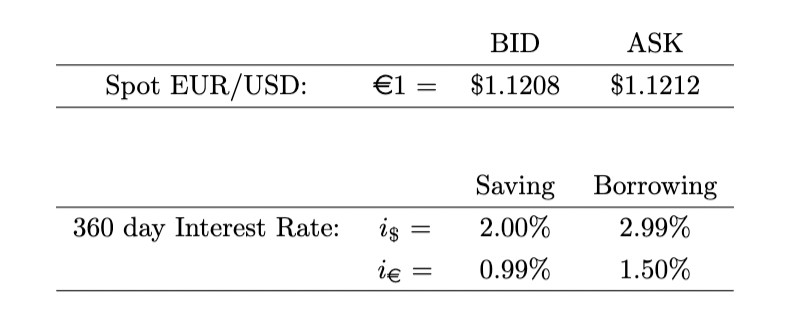

a) Using the information in the table below show how to execute a currency carry trade.(If you think you should borrow from the U.S. then starting with borrowing $1000. If you think you should borrow from the euro market, then start from borrowing 1000.)

b) In 360 days, for what level of exchange rate will the currency carry trade be profitable?(In other words, what is the maximum level of the exchange rate (EUR/USD:1 =$... ) for which the currency carry trade will be profitable?) Specify if it is Bid or Ask quote.

BID ASK Spot EUR/USD: 1 = $1.1208 $1.1212 360 day Interest Rate: is Saving Borrowing 2.00% 2.99% 0.99% 1.50% ie =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts