Question: A) Using the replacement chain approach, which project would you chose to invest in? B) Using the equivalent annual annuity approach, which project would you

A) Using the replacement chain approach, which project would you chose to invest in?

B) Using the equivalent annual annuity approach, which project would you chose to invest in?

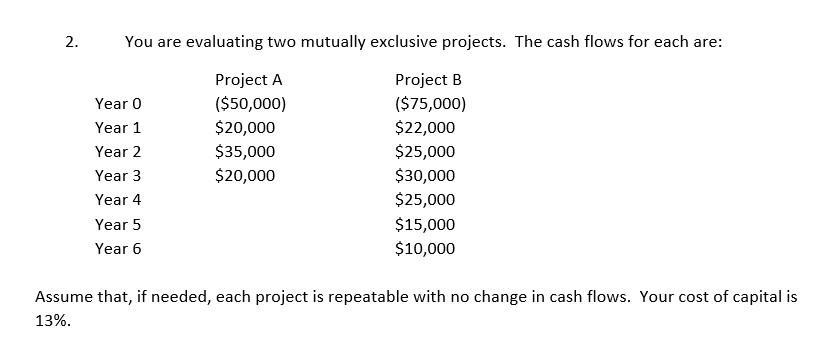

2. You are evaluating two mutually exclusive projects. The cash flows for each are: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Project A ($50,000) $20,000 $35,000 $20,000 Project B ($75,000) $22,000 $25,000 $30,000 $25,000 $15,000 $10,000 Assume that, if needed, each project is repeatable with no change in cash flows. Your cost of capital is 13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts