Question: (a) V Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31, 2021. The weighted-average number of shares outstanding 1751425

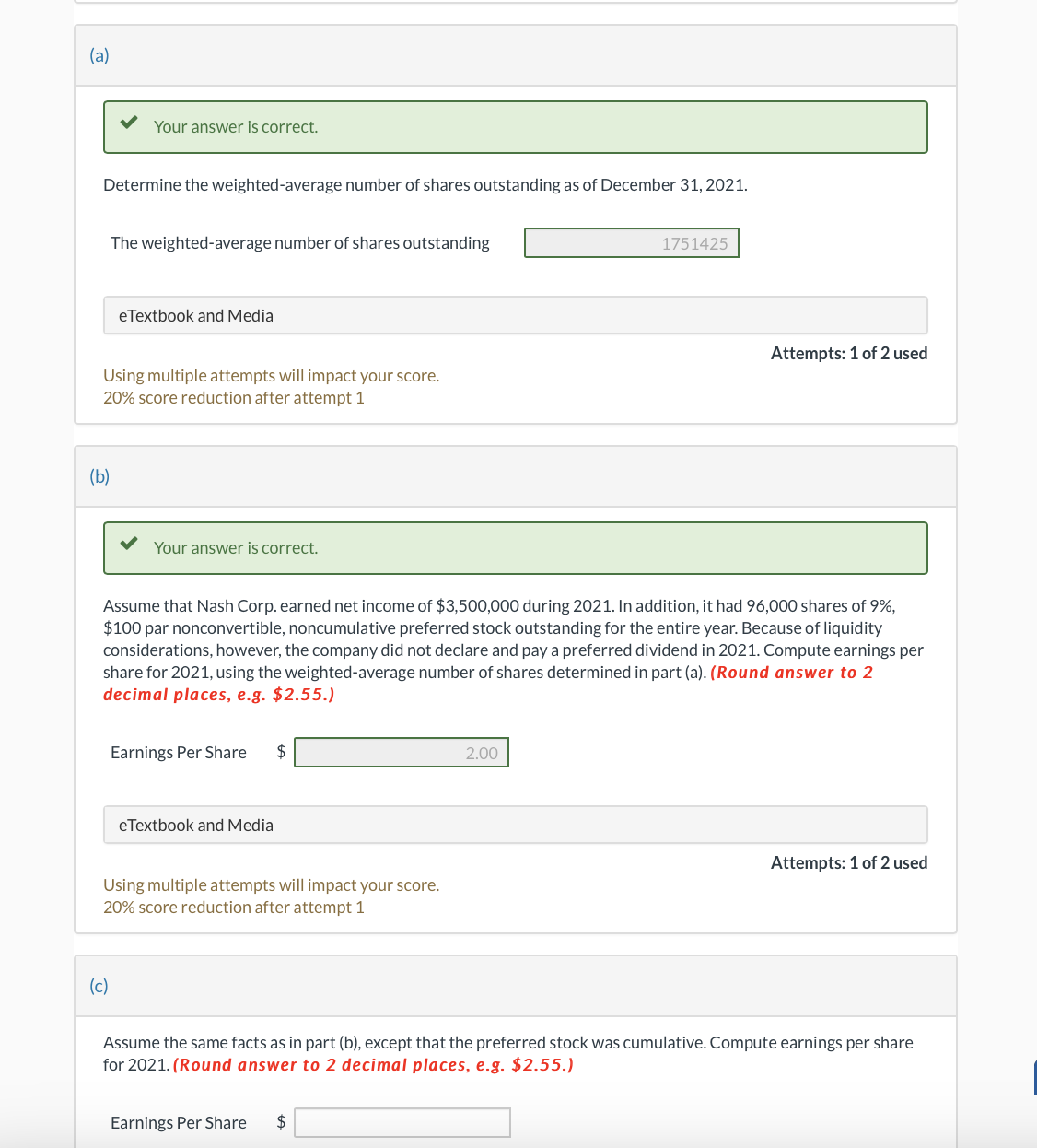

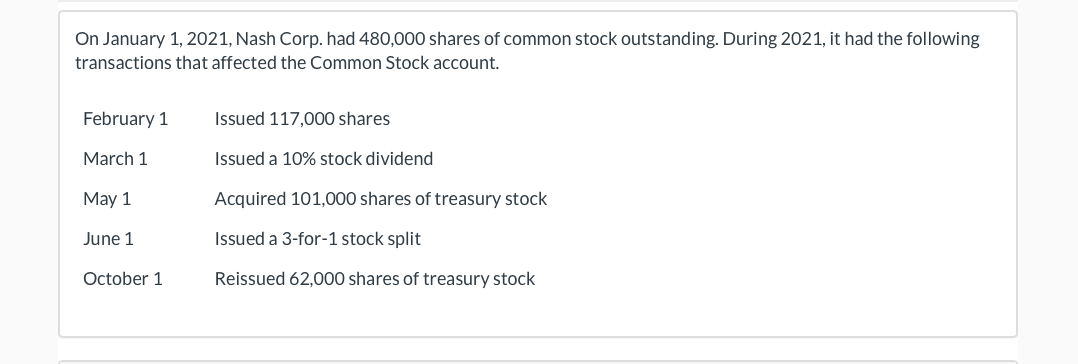

(a) V Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31, 2021. The weighted-average number of shares outstanding 1751425 eTextbook and Media Attempts: 1 of 2 used Using multiple attempts will impact your score. 20% score reduction after attempt 1 (b) V Your answer is correct. Assume that Nash Corp. earned net income of $3,500,000 during 2021. In addition. it had 96,000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2021. Compute earnings per share for 2021,using the weighted-average number of shares determined in part {a}. [Round answer to 2 decimal places, e.g. $2.55.) eTextbook and Media Attempts: 1 of 2 used Using multiple attempts will impact your score. 20% score reduction after attempt 1 (Cl Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earnings per share for 2021. {Round answer to 2 decimal places, e.g. $2.55.} Earnings Per Share $ On January 1, 2021, Nash Corp. had 480,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 Issued 117,000 shares March 1 Issued a 10% stock dividend May 1 Acquired 101,000 shares of treasury stock June 1 Issued a 3-for-1 stock split October 1 Reissued 62,000 shares of treasury stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts