Question: A VC firm is considering two different structures for its new $100M fund. Both structures would have management fees of 2.5 percent per year (on

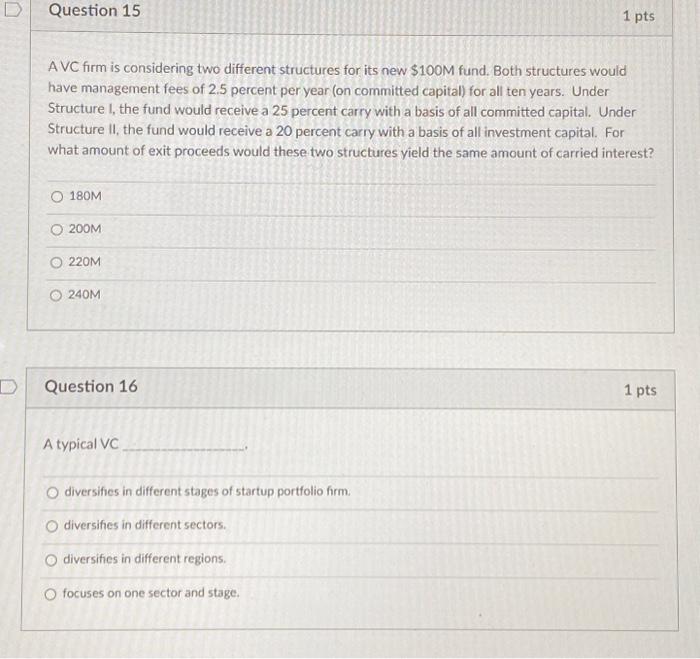

A VC firm is considering two different structures for its new $100M fund. Both structures would have management fees of 2.5 percent per year (on committed capital) for all ten years. Under Structure I, the fund would receive a 25 percent carry with a basis of all committed capital. Under Structure II, the fund would receive a 20 percent carry with a basis of all investment capital. For what amount of exit proceeds would these two structures yield the same amount of carried interest? 180M 200M 220M 240M Question 16 1 pts A typical VC diversifies in different stages of startup portfolio firm. diversifies in different sectors. diversifies in different regions. focuses on one sector and stage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts