Question: A vers 1 ABCDE Abcde | No spacing AaBbCcDc ABCDE A Heading 2 Potential Problems with IRR Q1: What is normal cash flows and non-normal

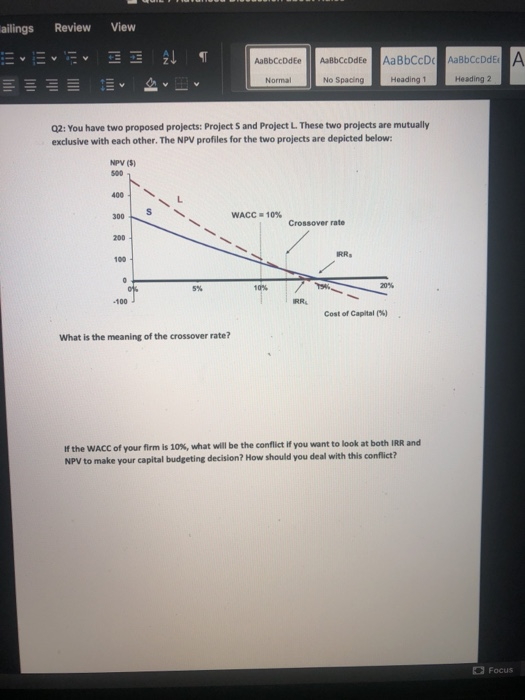

A vers 1 ABCDE Abcde | No spacing AaBbCcDc ABCDE A Heading 2 Potential Problems with IRR Q1: What is normal cash flows and non-normal cash flows? What is the key difference between normal cash flows and non-normal cash flows? Please show me an example of normal cash flows and of non-normal cash flows, respectively. An example the the timeline) of normal cash flows: An example (i.e. the timeline) of non-normal cash flows: if your project has non-normal cash flows, what is the problem you might encounter if you want to calculate the IRR of your project? How should you deal with this problem? Focus View ailings Review Eveva I AaBbCcDdEe Normal ABCDdEe No Spacing AaBbCcDc ABCDE A Heading 1 Heading 2 Normal Q2: You have two proposed projects: Projects and Project L. These two projects are mutually exclusive with each other. The NPV profiles for the two projects are depicted below: NPV WACC - 10% Cost of Capital What is the meaning of the crossover rate? If the WACC of your firm is 10%, what will be the conflict if you want to look at both IRR and NPV to make your capital budgeting decision? How should you deal with this conflict? Focus Eveva 33 0 AaBbCcDdEe AaBbceDdee No Spacing AaBbCcDc AaBbcc Heading 1 Heading Normal Q3: What is the reinvestment rate assumption for the NPV method and for the IRR method? Which one is better? What is the reinvestment rate assumption for the MIRR method? What are the three steps to find the MIRR? View aces A Mailings Review ver All I AaBbCcDdEe AaBbccdee No Spacing AaBbCcDc AaBbCcDdEt Heading 1 Heading 2 Normal What are the two key reasons that make the MIRR method better than the IRR method? Foc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts